Virgin Media 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

LONG TERM DEBT

An analysis of our long term debt facilities, including the impact of hedging activity and our capital optimization programs

is provided below. Further details of long term debt instruments are provided in note 5, Long Term Debt, in Item 8 of

this Form 10-K, with full details being contained in the current report on Form 8-K as filed with the SEC on or around

the date of issuance or amendment of the relevant instrument.

Under the terms of the Merger Agreement we signed with Liberty Global on February 5, 2013, our financial indebtedness

will be materially changed and the level of debt increased. The instruments described below will be subject to change

on consummation of the merger. For more information on the proposed merger see the Recent Developments section

of Item 1 of this Form 10-K.

Senior Unsecured Notes

Our wholly owned subsidiary Virgin Media Finance PLC, or VMF, has issued senior unsecured notes in a mix of

principally U.S. dollar and Sterling denominated instruments:

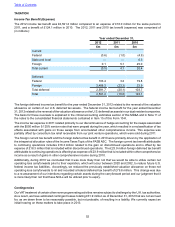

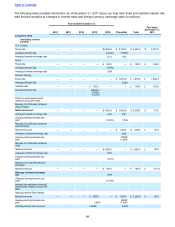

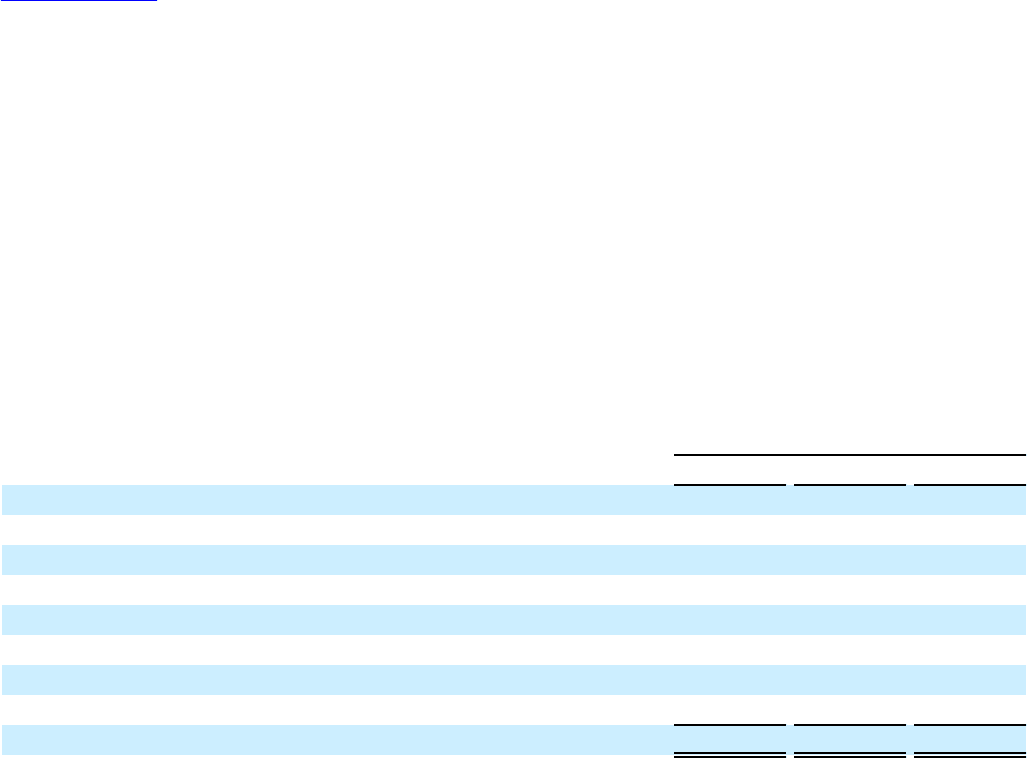

Carrying value (£ million)

Senior unsecured notes Issue date Annual interest date 2012 2011 2010

$550m 9.125% U.S. dollar due Aug 15, 2016 July 2006 Feb 15th & Aug 15th £ — £ — £ 352.6

$1,350m 9.5% U.S. dollar due Aug 15, 2016 June 2009 Feb 15th & Aug 15th — 849.2 843.2

€180m 9.5% euro due Aug 15, 2016 June 2009 Feb 15th & Aug 15th — 145.3 148.5

$600m 8.375% U.S. dollar due Oct 15, 2019(1) November 2009 Apr 15th & Oct 15th 309.3 380.6 378.8

£350m 8.875% Sterling due Oct 15, 2019(2) November 2009 Apr 15th & Oct 15th 250.3 345.2 344.8

$500m 5.25% U.S. dollar due Feb 15, 2022 March 2012 Feb 15th & Aug 15th 308.9 — —

$900m 4.875% U.S. dollar due Oct 30, 2022 October 2012 Feb 15th & Aug 15th 555.9 — —

£400m 5.125% Sterling due Oct 30, 2022 October 2012 Feb 15th & Aug 15th 400.0 — —

Total senior unsecured notes £ 1,824.4 £ 1,720.3 £2,067.9

(1) Principal amount outstanding at December 31, 2012 was $507.1 million following partial redemption of $92.9 million on October 30, 2012

(2) Principal amount outstanding at December 31, 2012 was £253.5 million following partial redemption of £96.5 million on October 30, 2012

We have entered in to cross currency interest rate swaps to mitigate the interest and foreign exchange risks associated

with our U.S. dollar, and historically euro, denominated debt, which for the U.S. dollar senior unsecured notes due

2019 and 2022 increases the weighted average interest rate to 9.02% and 5.35% respectively.

The principal value of our senior unsecured notes outstanding has increased to £1,824.4 million at December 31, 2012

from £1,720.3 million at December 31, 2011, with the weighted average interest rate including the effect of cross-

currency interest rate swaps reducing from 9.58% to 6.4%.

In 2011 total senior unsecured notes reduced to £1,720.3 million compared to £2,067.9 million at December 31, 2010,

with the weighted average interest rate including cross currency interest rate swaps increasing from 9.43% in 2010 to

9.58% in 2011.

The movements in weighted average interest rates in both 2012 and 2011 are as a result of our program to refinance

higher coupon debt, the principal transactions being:

• On July 26, 2011 we fully redeemed the 9.125% senior notes due 2016 by paying $575.1 million, or £355.8 million

of cash.

• On March 13, 2012, we issued U.S. dollar denominated 5.25% senior notes due February 15, 2022 with a principal

value of $500 million, the net proceeds of which together with cash on our balance sheet were used on March 28,

2012 to redeem $500 million of the principal amount of our $1,350 million 9.50% senior notes due 2016. We

recognized a loss on extinguishment of debt of £58.6 million as a result of this redemption.

• On October 30, 2012, we issued $900 million aggregate principal amount of 4.875% senior notes and £400 million

aggregate principal amount of 5.125% senior notes due October 30, 2022 at par, the net proceeds of which were

used to redeem our remaining $850 million and €180 million 9.50% senior notes due 2016, and $92.9 million of

the principal amount of our $600 million 8.375% senior notes due 2019 and £96.5 million of the principal amount

of our £350 million 8.875% senior notes due 2019. We recognized a loss on extinguishment of debt of £129.2

million as a result of these redemptions.

Table of Contents