Virgin Media 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

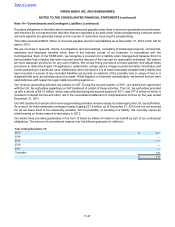

F-44

different U.S. tax consequences. It is impractical to estimate the amount of U.S. tax that would be recognized upon

the reversal of this basis difference because of the uncertainty regarding the manner in which such a transaction and

potential remittance might take place, the availability and complexity of calculating foreign tax credits that may be

available, and the implications of indirect taxes.

Note 12—Related Party Transactions

Virgin Enterprises Limited

We have identified Virgin Enterprises Limited as a related party to us. Virgin Entertainment Investment Holdings Limited

became a holder of our common stock as a result of our acquisition of Virgin Mobile on July 4, 2006. As of December 31,

2012, Virgin Entertainment Investment Holdings Limited beneficially owned 2.5% of our common stock (based on SEC

filings). Virgin Enterprises Limited is a wholly owned subsidiary of Virgin Entertainment Investment Holdings Limited.

In addition, Gordon McCallum is a member of our Board of Directors and is a Director of Virgin Enterprises Limited.

We own and have the right to use registered trademarks, including the exclusive right to use the “Virgin” name and

logo in connection with our corporate activities and in connection with the activities of our consumer business under

license from Virgin Enterprises Limited. This license with Virgin Enterprises Limited is for a 30-year term and exclusive

to us within the U.K. and Ireland. The license entitles us to use the “Virgin” name for the TV, broadband internet,

telephone and mobile phone services we provide to our residential customers, as well as the acquisition and branding

of sports, movies and other premium television content and the sale of certain communications equipment, such as

set top boxes and cable modems. Our license agreement provides for an annual royalty of 0.25% of certain consumer

revenues, subject to a minimum annual royalty of £8.5 million. As part of the agreement, we have the right to adopt,

and have adopted, a company name for our parent, Virgin Media Inc., over which together with the name “Virgin Media”,

we retain worldwide exclusivity. Under a related agreement, Virgin Enterprises Limited has the right to propose a

candidate to fill a seat on our Board of Directors. Pursuant to this right, Virgin Enterprises Limited proposed Gordon

McCallum who was appointed to our Board of Directors.

During the first quarter of 2010, ntl:Telewest Business announced that it would rebrand using the Virgin trade marks

to “Virgin Media Business”. Virgin Media has entered into a trade mark license with Virgin Enterprises Limited under

which an annual royalty is payable of 0.25% of revenues from our business segment, subject to a minimum payment

of £1.5 million.

During the years ended December 31, 2012, 2011 and 2010, respectively, we incurred expenses of £10.2 million, £10.1

million, and £10.1 million for charges in respect of brand licensing and promotion of which £5.1 million, £5.0 million

and £4.7 million was payable at December 31, 2012, 2011 and 2010, respectively.

Other Virgin Companies

As a licensee of the “Virgin” brand name, we participate in mutually beneficial activities with other Virgin companies.

These arrangements are in the ordinary course of business and believed to be on arm’s length terms.

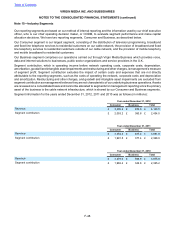

UKTV Joint Ventures

Through our wholly owned subsidiary, Flextech Broadband Limited, we owned a 50% equity investment in the UKTV

joint venture companies until September 30, 2011, when the sale of UKTV was completed. We have therefore identified

the UKTV joint venture companies as related parties to us for the period to September 30, 2011. We also carry the

UKTV channels in our pay television packages available to our customers.

We pay UKTV for purchases of television programming rights. During the years ended December 31, 2011 and 2010,

the net expense recognized in respect to these transactions through the consolidated statement of comprehensive

income totaled £24.4 million and £24.8 million, respectively.

During the years ended December 31, 2011 and 2010, we received cash payments from UKTV for loan principal

payments, interest, dividends and consortium tax relief totaling £34.0 million and £34.4 million, respectively.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

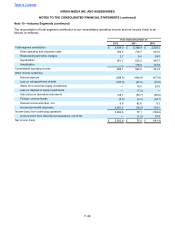

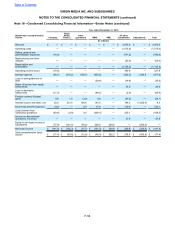

Note 11—Income Taxes (continued)