Virgin Media 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-104

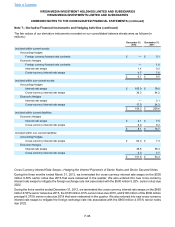

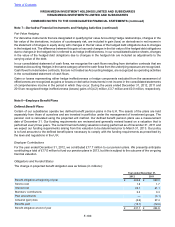

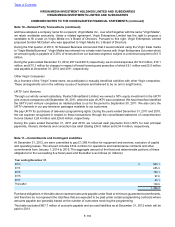

Estimated Future Benefit Payments

The benefits expected to be paid out of the pension plans in total are set out below for each of the next five years and

the following five years in aggregate. The benefits expected to be paid are based on the same assumptions used to

measure our benefit obligation at December 31, 2012 and include estimated future employee services (in millions):

Year ending December 31: Pension

Benefits

2013 £ 15.6

2014 16.6

2015 17.6

2016 18.7

2017 19.8

Years 2018-2022 £ 119.9

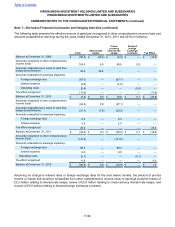

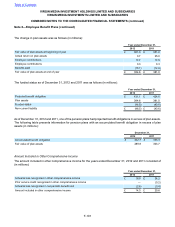

Defined Contribution Pension Plans

Our subsidiaries operate defined contribution pension plans in the U.K. The total expense in relation to these plans

was £13.7 million, £13.6 million and £14.0 million for the years ended December 31, 2012, 2011 and 2010,

respectively.

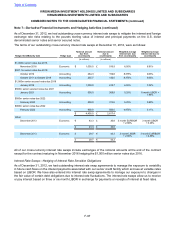

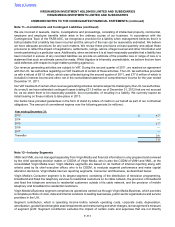

Note 9—Income Taxes

Overview

For the year ended December 31, 2012 we recognized an income tax benefit of £2,531.1 million compared to an

expense of £15.6 million and a benefit of £127.9 million in the years ended December 31, 2011 and 2010 respectively.

The significant benefit recognized during 2012 related to the reversal of the valuation allowance on certain of our

deferred tax assets.

Deferred tax valuation allowance

As at December 31, 2012 we had gross deferred tax assets of £5,418.7 million, of which £5,232.1 million related to

the U.K. and which principally comprised capital allowances, net operating losses, or NOLs, and capital losses. We

accumulated these assets over the last two decades as we made significant investments in building our network

infrastructure and incurred significant losses as we operated that network. These assets represent amounts we, in

common with other companies in the U.K., are able to use to reduce our future taxable profits in the U.K. We have

historically maintained a full valuation allowance on both our U.K. and U.S. deferred tax assets, reducing the value of

these assets on our balance sheet to zero.

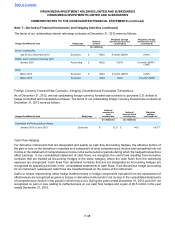

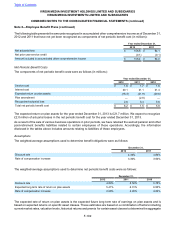

The assessment of the amount of value assigned to our deferred tax assets under the applicable accounting rules is

highly judgmental. We are required to consider all available positive and negative evidence in evaluating the likelihood

that we will be able to realize the benefit of our deferred tax assets in the future. Such evidence includes scheduled

reversals of deferred tax liabilities, projected future taxable income, tax-planning strategies, and the results of recent

operations. Since this evaluation requires consideration of events that may occur some years into the future, there is

significant judgment involved, and our conclusion could be materially different should certain of our expectations not

transpire.

When assessing all available evidence, we consider that an important piece of objective evidence is the extent to

which we have made pre-tax income or losses over the most recent three year period. Historically, we have maintained

a full valuation allowance on our net deferred tax assets principally because we have been in a cumulative pre-tax

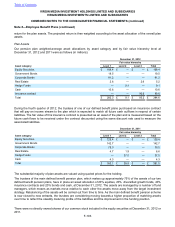

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 8—Employee Benefit Plans (continued)