Virgin Media 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-111

We are involved in lawsuits, claims, investigations and proceedings, consisting of intellectual property, commercial,

employee and employee benefits which arise in the ordinary course of our business. In accordance with the

Contingencies Topic of the FASB ASC, we recognize a provision for a liability when management believes that it is

both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. We believe

we have adequate provisions for any such matters. We review these provisions at least quarterly and adjust these

provisions to reflect the impact of negotiations, settlements, rulings, advice of legal counsel and other information and

events pertaining to a particular case. Additionally, when we believe it is at least reasonably possible that a liability has

been incurred in excess of any recorded liabilities we provide an estimate of the possible loss or range of loss or a

statement that such an estimate cannot be made. While litigation is inherently unpredictable, we believe that we have

valid defenses with respect to legal matters pending against us.

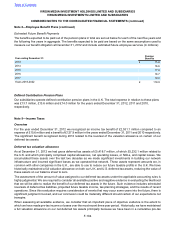

Our revenue generating activities are subject to VAT. During the second quarter of 2011, we reached an agreement

with the U.K. tax authorities regarding our VAT treatment of certain of these activities. The U.K. tax authorities provided

us with a refund of £81.5 million, which was collected during the second quarter of 2011, and £77.6 million of which is

included in interest income and other, net in the consolidated statement of comprehensive income for the year ended

December 31, 2011.

Our VAT treatment of certain other revenue generating activities remains subject to challenge by the U.K. tax authorities.

As a result, we have estimated contingent losses totaling £31.9 million as of December 31, 2012 that are not accrued

for, as we deem them to be reasonably possible, but not probable, of resulting in a liability. We currently expect an

initial hearing on these matters to take place in 2013.

Our banks have provided guarantees in the form of stand by letters of credit on our behalf as part of our contractual

obligations. The amount of commitment expires over the following periods (in millions):

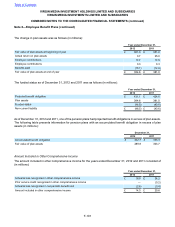

Year ending December 31:

2013 £ 4.7

2014 —

2015 1.7

2016 —

2017 —

Thereafter 0.6

7.0

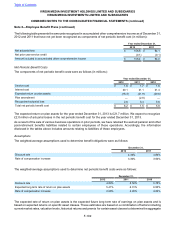

Note 12—Industry Segments

VMIH and VMIL are not managed separately from Virgin Media and financial information is only prepared and reviewed

by the chief operating decision maker, or CODM, of Virgin Media, who is also the CODM of VMIH and VMIL, at the

consolidated Virgin Media level. Virgin Media’s segments are based on its method of internal reporting along with

criteria used by its chief executive officer, who is its CODM, to evaluate segment performance and make capital

allocation decisions. Virgin Media has two reporting segments, Consumer and Business, as described below:

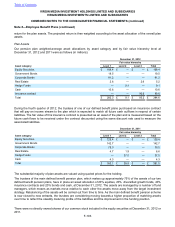

Virgin Media’s Consumer segment is its largest segment, consisting of the distribution of television programming,

broadband and fixed line telephony services to residential customers on its cable network, the provision of broadband

and fixed line telephone services to residential customers outside of its cable network, and the provision of mobile

telephony and broadband to residential customers.

Virgin Media’s Business segment comprises its operations carried out through Virgin Media Business, which provides

a complete portfolio of voice, data and internet solutions to leading businesses, public sector organizations and service

providers in the U.K.

Segment contribution, which is operating income before network operating costs, corporate costs, depreciation,

amortization, goodwill and intangible asset impairments and restructuring and other charges, is management’s measure

of segment profit. Segment contribution excludes the impact of certain costs and expenses that are not directly

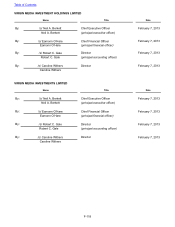

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 11—Commitments and Contingent Liabilities (continued)