Virgin Media 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-41

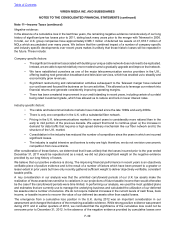

Income tax benefit (expense)

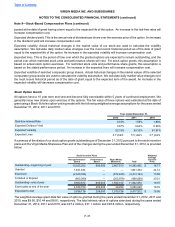

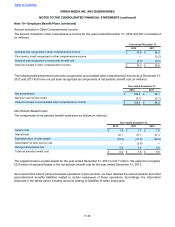

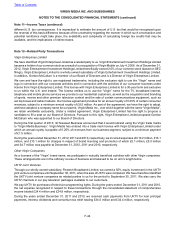

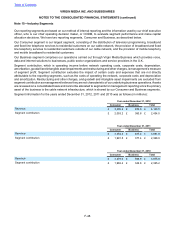

The benefit (expense) for income taxes consists of the following (in millions):

Year ended December 31,

2012 2011 2010

Current:

Federal £ (0.6) £ (1.0) £ (4.9)

State and local — — 0.3

Foreign 0.1 5.1 25.0

Total current (0.5) 4.1 20.4

Deferred:

Federal 103.4 3.2 79.8

Foreign 2,488.3 (23.3) 23.9

Total deferred 2,591.7 (20.1) 103.7

Total £ 2,591.2 £ (16.0) £ 124.1

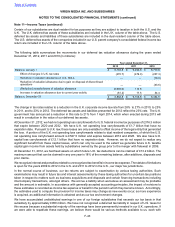

The foreign deferred income tax benefit for the year ended December 31, 2012 related to the reversal of the valuation

allowance on certain of our U.K. deferred tax assets. The federal income tax benefit for the year ended December

31, 2012 related to the reversal of the valuation allowance on the U.S. deferred tax assets in our dual resident companies.

Based on the location of the entity to which earnings are attributable, consolidated income from continuing operations

before income taxes for U.S. based operations was £45.4 million in 2012, losses of £122.4 million in 2011 and losses

of £61.3 million in 2010 and the corresponding amounts for non-U.S. based operations were income of £216.0 million

and £215.5 million in 2012 and 2011 respectively, and losses of £240.0 million in 2010 . However taxation of an entity's

earnings may not correlate solely to where an entity is located and because of this the distribution of income tax benefit

(expense) presented above between U.S. and non-U.S. may not correspond to the distribution of earnings presented

above.

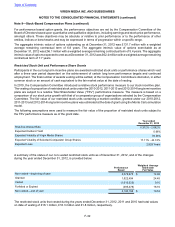

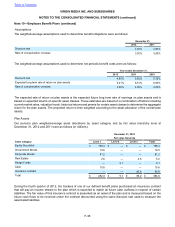

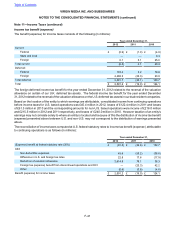

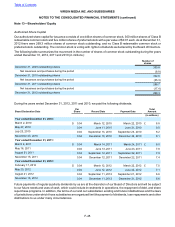

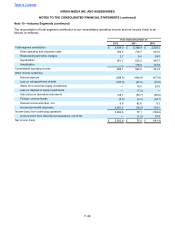

The reconciliation of income taxes computed at U.S. federal statutory rates to income tax benefit (expense) attributable

to continuing operations is as follows (in millions):

Year ended December 31,

2012 2011 2010

(Expense) benefit at federal statutory rate (35%) £ (91.5) £ (32.6) £ 102.7

Add:

Non-deductible expenses 45.6 (55.2) (36.6)

Difference in U.S. and foreign tax rates 22.8 17.6 (17.9)

Reduction of valuation allowance 2,614.9 78.1 38.3

Foreign tax (expense) benefit from discontinued operations and OCI — (23.3) 42.2

Other (0.6) (0.6) (4.6)

Benefit (expense) for income taxes £ 2,591.2 £ (16.0) £ 124.1

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 11—Income Taxes (continued)