Virgin Media 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-12

with foreign currency payments in relation to operating costs and purchases of fixed assets incurred in the normal

course of business.

Our objective in managing exposure to fluctuations in interest rates and foreign currency exchange rates is to decrease

the volatility of our earnings and cash flows caused by changes in underlying rates. To achieve this objective, we have

entered into derivative financial instruments. We have established policies and procedures to govern the management

of these exposures through a variety of derivative financial instruments, including interest rate swaps, cross-currency

interest rate swaps and foreign currency forward rate contracts. By policy, we do not enter into derivative financial

instruments with a level of complexity or with a risk that is greater than the exposure to be managed.

In order to qualify for hedge accounting in accordance with the Derivatives and Hedging Topic of the FASB ASC we

are required to document in advance the relationship between the item being hedged and the hedging instrument. We

are also required to demonstrate that the hedge will be highly effective on an ongoing basis. This effectiveness testing

is performed and documented at each period end to ensure that the hedge remains highly effective.

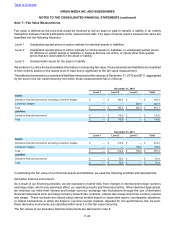

We recognize all derivative financial instruments as either assets or liabilities measured at fair value. Gains and losses

resulting from changes in fair value are accounted for depending on the use of the derivative and whether it is designated

and qualifies for hedge accounting. To the extent that the derivative instrument is designated and considered to be

effective as a cash flow hedge of an exposure to future changes in interest rates or foreign currency exchange rates,

the change in fair value of the instrument is deferred in accumulated other comprehensive income or loss. Amounts

recorded in accumulated other comprehensive income or loss are reclassified to net income in the statement of

comprehensive income in the same period as the corresponding impact on earnings from the underlying hedged

transaction. Changes in the fair value of any instrument not designated as an accounting hedge or considered to be

ineffective as an accounting hedge are reported in earnings immediately.

Where an accounting hedge no longer meets the effectiveness criteria, any gains or losses deferred in equity are only

transferred to net income in the statement of comprehensive income when the committed or forecasted transaction is

recognized in the statement of comprehensive income. However, where we have applied cash flow hedge accounting

for a forecasted or committed transaction that is no longer expected to occur, then the cumulative gain or loss that has

been recorded in equity is recognized immediately as a gain or loss on derivative instruments in the statement of

comprehensive income.

Equity-linked Instruments

We determine the accounting treatment of equity-linked instruments according to the Distinguishing Liabilities from

Equity and Derivatives and Hedging Topics of the FASB ASC. This involves assessing whether the instrument falls

within the scope of the first topic and should be classified as an asset, liability or as equity. If the guidance in the first

topic is not applicable, we evaluate the instrument according to the second topic to determine whether it is indexed to

our stock and if necessary, whether it would be classified in equity.

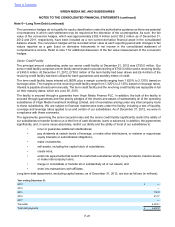

Operating Leases

Our leasing activities are principally related to administrative facilities, network related facilities, retail facilities and

operating equipment. These leases generally provide us with renewal options. Certain leases contain fluctuating or

escalating payments and rent holiday periods. The related rent expense is recorded on a straight line basis over the

lease term.

Contingent rent is not a material component of our total rent expense.

Income Taxes

We provide for income taxes in accordance with the Income Taxes Topic of the FASB ASC. Judgment is required in

determining our provision for income taxes, deferred tax assets and liabilities and the extent to which valuation

allowances are necessary to reduce our deferred tax assets. We recognize valuation allowances if it is not more likely

than not that sufficient taxable income will be available in the future against which the temporary differences and unused

tax losses can be utilized. We have considered future taxable income and tax planning strategies in assessing whether

deferred tax assets should be recognized.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 2—Significant Accounting Policies (continued)