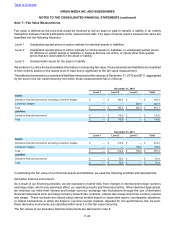

Virgin Media 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-21

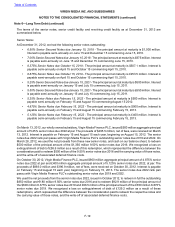

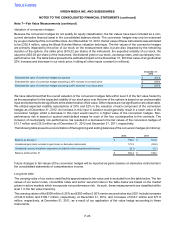

The conversion hedges do not qualify for equity classification under the authoritative guidance as there are potential

circumstances in which cash settlement may be required at the discretion of the counterparties. As such, the fair

value of the conversion hedges, which was approximately £302.4 million and £138.2 million as of December 31,

2012 and 2011, respectively, have been included as a non-current derivative financial asset in the consolidated

balance sheets. The conversion hedges will be recorded at fair value at each reporting period with changes in fair

values reported as a gain (loss) on derivative instruments in net income in the consolidated statement of

comprehensive income. Refer to note 7 for additional discussion of the fair value measurement of the conversion

hedges.

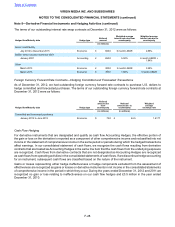

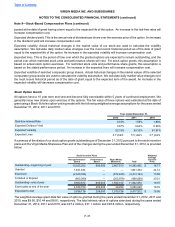

Senior Credit Facility

The principal amount outstanding under our senior credit facility at December 31, 2012 was £750.0 million. Our

senior credit facility comprises a term facility denominated in pounds sterling of £750.0 million and a revolving facility

of £450.0 million. At December 31, 2012, £750.0 million of the term facility had been drawn and £6.4 million of the

revolving credit facility had been utilized for bank guarantees and standby letters of credit.

The term credit facility bears interest at LIBOR, plus a margin currently ranging from 1.625% to 2.125% based on

leverage ratios. The margins on the revolving credit facility range from 1.325% to 2.125% based on leverage ratios.

Interest is payable at least semi-annually. The term credit facility and the revolving credit facility are repayable in full

on their maturity dates, which are June 30, 2015.

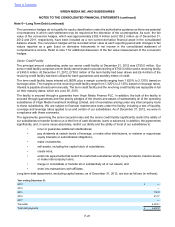

The facility is secured through a guarantee from Virgin Media Finance PLC. In addition, the bulk of the facility is

secured through guarantees and first priority pledges of the shares and assets of substantially all of the operating

subsidiaries of Virgin Media Investment Holdings Limited, and of receivables arising under any intercompany loans

to those subsidiaries. We are subject to financial maintenance tests under the facility, including a test of liquidity,

coverage and leverage ratios applied to us and certain of our subsidiaries. As of December 31, 2012, we were in

compliance with these covenants.

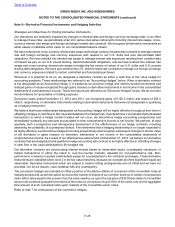

The agreements governing the senior secured notes and the senior credit facility significantly restrict the ability of

our subsidiaries to transfer funds to us in the form of cash dividends, loans or advances. In addition, the agreements

significantly, and, in some cases absolutely, restrict our ability and the ability of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends at certain levels of leverage, or make other distributions, or redeem or repurchase

equity interests or subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• create liens;

• enter into agreements that restrict the restricted subsidiaries' ability to pay dividends, transfer assets

or make intercompany loans;

• merge or consolidate or transfer all or substantially all of our assets; and

• enter into transactions with affiliates.

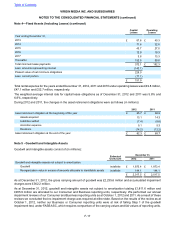

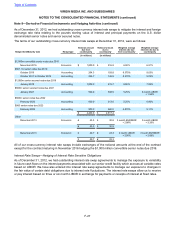

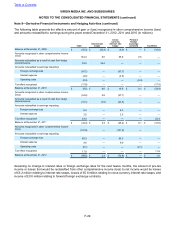

Long term debt repayments, excluding capital leases, as of December 31, 2012, are due as follows (in millions):

Year ending December 31:

2013 £ —

2014 —

2015 750.0

2016 617.7

2017 —

Thereafter 4,283.1

Total debt payments £ 5,650.8

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 6—Long Term Debt (continued)