Virgin Media 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-46

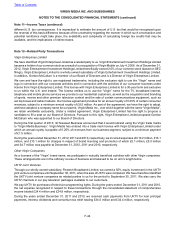

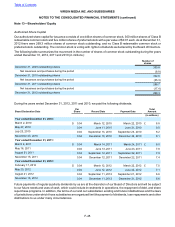

Capital Structure Optimization

On July 27, 2011, we announced Phase 2 of our structure optimization program which included the application of up

to £625 million for purposes of repurchasing our common stock. Phase 2 was extended on October 27, 2011, with

the announcement of our intention to expend up to a further £250 million on share repurchases from the proceeds

from the sale of our UKTV joint venture companies. These repurchases were completed during 2012 as part of the

second phase program. At December 31, 2012 we had £122.5 million remaining under this program.

On February 8, 2012, we entered into a capped Accelerated Stock Repurchase (ASR) to purchase $250 million (£157.3

million) of our common stock. We received 10.2 million shares of common stock in connection with this ASR at an

average purchase price per share of $24.58. The ASR was terminated on March 26, 2012 and the shares of common

stock so acquired were cancelled. A further capped ASR commenced on July 24, 2012 to purchase $175 million

(£112.7 million) of our common stock. We received 6.1 million shares of common stock in connection with this ASR at

an average purchase price per share of $28.71. The ASR was terminated on October 26, 2012 and the shares of

common stock so acquired were cancelled. Both ASRs undertaken during 2012 were under the authority of the 2011

capital optimization program.

During 2012 we made open market repurchases of 4.2 million shares of common stock in connection with the second

phase capital structure optimization program, at an average purchase price per share of $22.54 ($94.9 million, £60.3

million, in aggregate). The shares of the common stock so acquired were cancelled.

During the year ended December 31, 2011, we repurchased approximately 40.9 million shares of common stock at an

average purchase price per share of $25.03 ($1,022.5 million in aggregate), of which approximately 17.1 million shares

were repurchased through open market repurchases at an average purchase price per share of $27.64 ($472.5 million

in aggregate) and approximately 23.8 million shares were repurchased through capped accelerated stock repurchase

programs at an average purchase price per share of $23.15 ($550 million in aggregate). These shares of common

stock so acquired were cancelled.

On December 14, 2012, we announced Phase 3 of our capital structure optimization program, which comprises a

planned share buyback of at least £1,122.5 million (including £122.5 million remaining under Phase 2 of the program)

to be completed before the end of 2014. Under the terms of the Merger Agreement we signed with Liberty Global on

February 5, 2013, we have suspended our capital returns program pending consummation of the merger. If the merger

is not consummated we intend to resume our capital returns program. For more information on the proposed merger

see note 18.

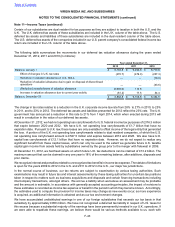

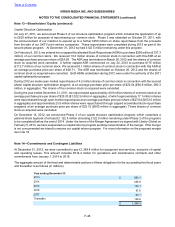

Note 14—Commitments and Contingent Liabilities

At December 31, 2012, we were committed to pay £1,369.4 million for equipment and services, exclusive of capital

and operating leases. This amount includes £514.4 million for operations and maintenance contracts and other

commitments from January 1, 2014 to 2019.

The aggregate amount of the fixed and determinable portions of these obligations for the succeeding five fiscal years

and thereafter is as follows (in millions):

Year ending December 31:

2013 £ 663.1

2014 255.9

2015 150.1

2016 97.6

2017 63.1

Thereafter 139.6

£ 1,369.4

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

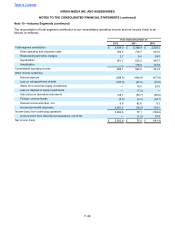

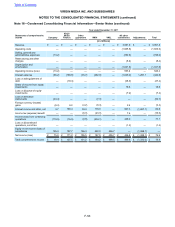

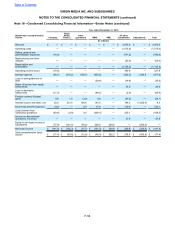

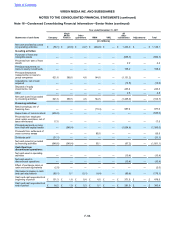

Note 13—Shareholders' Equity (continued)