Virgin Media 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-43

Certain of our subsidiaries are dual resident for tax purposes as they are subject to taxation in both the U.S. and the

U.K. The U.K. deferred tax assets of these subsidiaries are included in the U.K. column of the table above. The U.S.

deferred tax assets and liabilities of these subsidiaries are included in the dual resident column of the table above.

The U.S. deferred tax assets of the companies included in our U.S. parent company's consolidated federal income tax

return are included in the U.S. column of the table above.

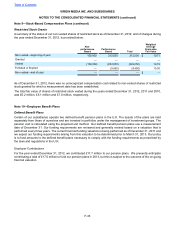

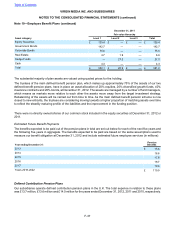

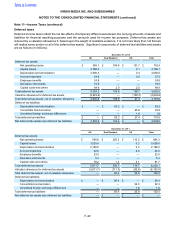

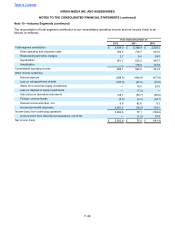

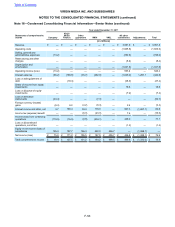

The following table summarizes the movements in our deferred tax valuation allowance during the years ended

December 31, 2012, 2011 and 2010 (in millions):

Year ended December 31,

2012 2011 2010

Balance, January 1 £ 6,103.8 £ 6,454.5 £ 6,770.8

Effect of changes in U.K. tax rates (470.7) (479.0) (237.3)

Reduction in valuation allowance on U.S. NOLs — — (79.8)

Reduction of valuation allowance due to gain on disposal of discontinued

operations — — (33.6)

(Reduction) establishment of valuation allowance (2,639.0) 110.8

Increase in valuation allowance due to current year activity (61.2) 17.5 34.4

Balance, December 31 £ 2,932.9 £ 6,103.8 £ 6,454.5

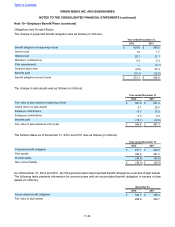

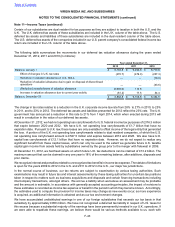

The change in tax rates relates to a reduction in the U.K. corporate income tax rate from 28% to 27% in 2010, to 25%

in 2011, and to 23% in 2012. The deferred tax assets and liabilities presented for 2012 reflect the 23% rate. The U.K.

government has announced a reduction in this rate to 21% from 1 April 2014, which when enacted during 2013 will

result in a reduction in the value of our deferred tax assets.

At December 31, 2012, we had net operating loss carryforwards for U.S. federal income tax purposes of £376.3 million

that expire between 2020 and 2032. We have U.K. net operating loss carryforwards of £1.7 billion that have no

expiration date. Pursuant to U.K. law, these losses are only available to offset income of the legal entity that generated

the loss. A portion of the U.K. net operating loss carryforwards relates to dual resident companies, of which the U.S.

net operating loss carryforward amount is £527.5 million and expires between 2012 and 2028. We also have U.K.

capital loss carryforwards of £12.1 billion that have no expiration date. However, we do not expect to realize any

significant benefit from these capital losses, which can only be used to the extent we generate future U.K. taxable

capital gain income from assets held by subsidiaries owned by the group prior to the merger with Telewest in 2006.

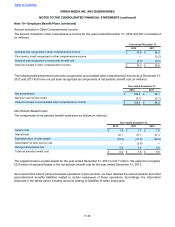

At December 31, 2012, we had fixed assets on which future U.K. tax deductions can be claimed of £13.2 billion. The

maximum amount that can be claimed in any one year is 18% of the remaining balance, after additions, disposals and

prior claims.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. The statute of limitations

is open for the years 2009 to 2012 in the U.S. and 2011 to 2012 in the U.K., our major tax jurisdictions.

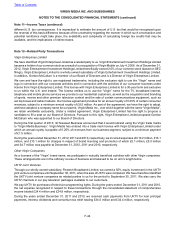

In the normal course of business, our tax returns are subject to examination by various taxing authorities. Such

examinations may result in future tax and interest assessments by these taxing authorities for uncertain tax positions

taken in respect to matters such as business acquisitions and disposals and certain financing transactions including

intercompany transactions, amongst others. We accrue a liability when we believe an assessment may be probable

and the amount is estimable. In accordance with generally accepted accounting principles, the impact of revisions to

these estimates is recorded as income tax expense or benefit in the period in which they become known. Accordingly,

the estimates used to compute the provision for income taxes may change as new events occur, as more experience

is acquired, as additional information is obtained and as our tax environment changes.

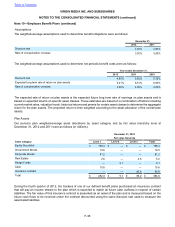

We have accumulated undistributed earnings in one of our foreign subsidiaries that exceeds our tax basis in that

subsidiary by approximately £950 million. We have not recognized a deferred tax liability in respect of U.S. taxes for

this excess because a substantial majority of the earnings have been permanently invested in our U.K. operations. If

we were able to repatriate these earnings, we believe there would be various methods available to us, each with

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 11—Income Taxes (continued)