Virgin Media 2012 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-100

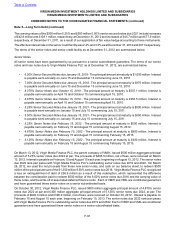

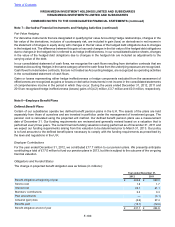

Fair Value Hedging

For derivative instruments that are designated in qualifying fair value Accounting Hedge relationships, changes in the

fair value of the derivatives, inclusive of counterparty risk, are included in gain (loss) on derivatives in net income in

the statement of changes in equity along with changes in the fair value of the hedged debt obligations due to changes

in the hedged risk. The difference between this gain or loss and changes in the fair value of the hedged debt obligations

due to changes in the hedged risk is referred to as hedge ineffectiveness. In our consolidated balance sheets, changes

in the value of the hedged debt obligations due to changes in the hedged risk are included as adjustments to the

carrying value of the debt.

In our consolidated statement of cash flows, we recognize the cash flows resulting from derivative contracts that are

treated as Accounting Hedges in the same category where the cash flows from the underlying exposure are recognized.

Cash flows from derivative contracts, that are not treated as Accounting Hedges, are recognized as operating activities

in the consolidated statement of cash flows.

Gains or losses representing either hedge ineffectiveness or hedge components excluded from the assessment of

effectiveness are recognized as gains or losses on derivative instruments in net income in the consolidated statements

of comprehensive income in the period in which they occur. During the years ended December 31, 2012, 2011 and

2010 we recognized hedge ineffectiveness (losses) gains of £(4.2) million, £3.7 million and £0.0 million, respectively.

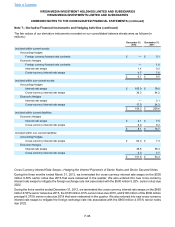

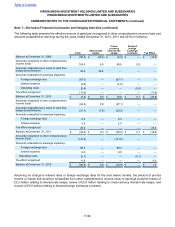

Note 8—Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate two defined benefit pension plans in the U.K. The assets of the plans are held

separately from those of ourselves and are invested in portfolios under the management of investment groups. The

pension cost is calculated using the projected unit method. Our defined benefit pension plans use a measurement

date of December 31. Our funding requirements are reviewed and generally revised based on a valuation that is

performed every three years. The current triennial funding valuation is being performed as of December 31, 2011 and

we expect our funding requirements arising from this valuation to be determined prior to March 31, 2013. Our policy

is to fund amounts to the defined benefit plans necessary to comply with the funding requirements as prescribed by

the laws and regulations in the U.K.

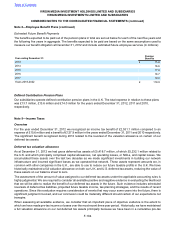

Employer Contributions

For the year ended December 31, 2012, we contributed £17.7 million to our pension plans. We presently anticipate

contributing a total of £17.0 million to fund our pension plans in 2013, but this is subject to the outcome of the on-going

triennial valuation.

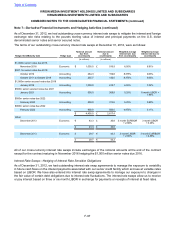

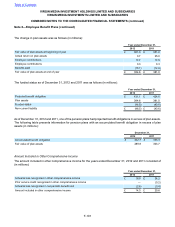

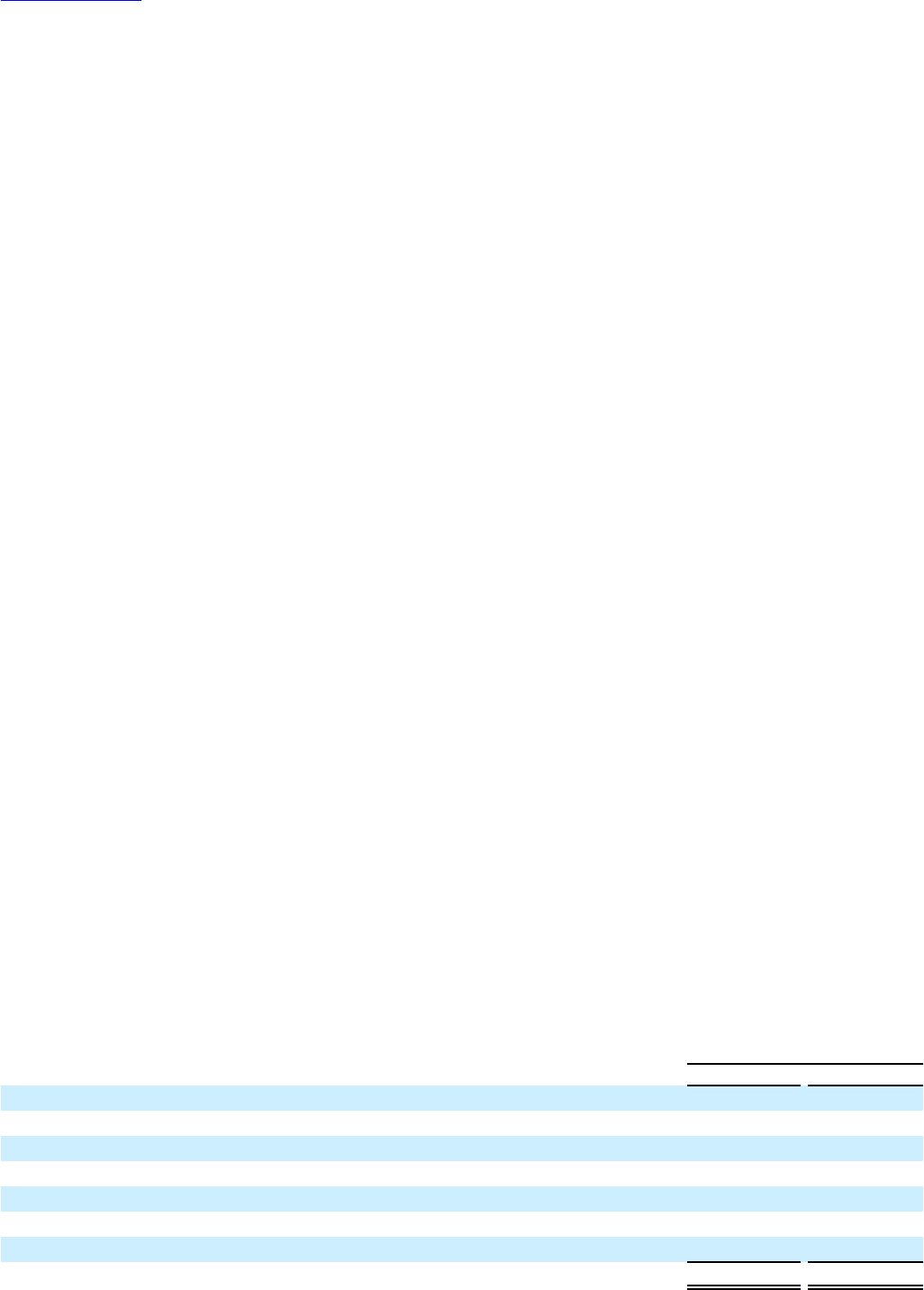

Obligations and Funded Status

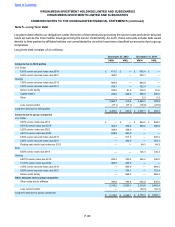

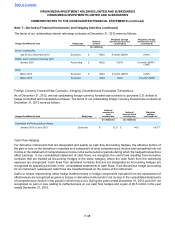

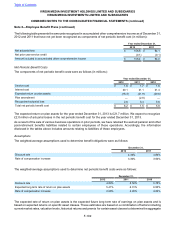

The change in projected benefit obligation was as follows (in millions):

Year ended December 31,

2012 2011

Benefit obligation at beginning of year £ 424.6 £ 390.0

Service cost 1.8 1.7

Interest cost 20.1 21.1

Members’ contributions 0.3 0.3

Plan amendments — (3.1)

Actuarial (gain) loss (0.6) 27.4

Benefits paid (15.1) (12.8)

Benefit obligation at end of year £ 431.1 £ 424.6

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 7—Derivative Financial Instruments and Hedging Activities (continued)