Virgin Media 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-22

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The types of inputs used to measure fair value are

classified into the following hierarchy:

Level 1 Unadjusted quoted prices in active markets for identical assets or liabilities

Level 2 Unadjusted quoted prices in active markets for similar assets or liabilities, or unadjusted quoted prices

for identical or similar assets or liabilities in markets that are not active, or inputs other than quoted

prices that are observable for the asset or liability

Level 3 Unobservable inputs for the asset or liability

We endeavor to utilize the best available information in measuring fair value. Financial assets and liabilities are classified

in their entirety based on the lowest level of input that is significant to the fair value measurement.

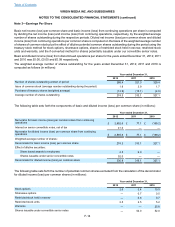

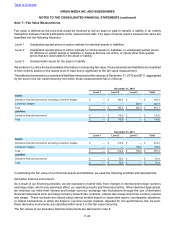

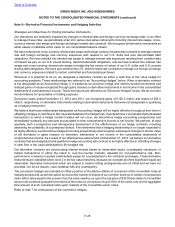

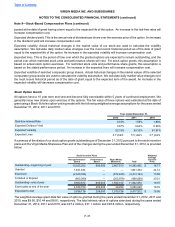

The tables below present our assets and liabilities measured at fair value as of December 31, 2012 and 2011, aggregated

by the level in the fair value hierarchy into which those measurements fall (in millions):

December 31, 2012

Level 1 Level 2 Level 3 Total

Assets

Derivative financial instruments, excluding conversion hedges £ — £ 165.3 £ — £ 165.3

Conversion hedges — — 302.4 302.4

Total £ — £ 165.3 £302.4 £467.7

Liabilities

Derivative financial instruments £ — £ 110.0 £ — £ 110.0

Total £ — £ 110.0 £ — £ 110.0

December 31, 2011

Level 1 Level 2 Level 3 Total

Assets

Derivative financial instruments, excluding conversion hedges £ — £ 219.2 £ — £ 219.2

Conversion hedges — — 138.2 138.2

Total £ — £ 219.2 £138.2 £357.4

Liabilities

Derivative financial instruments £ — £ 70.3 £ — £ 70.3

Total £ — £ 70.3 £ — £ 70.3

In estimating the fair value of our financial assets and liabilities, we used the following methods and assumptions:

Derivative financial instruments:

As a result of our financing activities, we are exposed to market risks from changes in interest and foreign currency

exchange rates, which may adversely affect our operating results and financial position. When deemed appropriate,

we minimize our risks from interest and foreign currency exchange rate fluctuations through the use of derivative

financial instruments such as foreign currency forward rate contracts, interest rate swaps and cross-currency interest

rate swaps. These contracts are valued using internal models based on observable inputs, counterparty valuations,

or market transactions in either the listed or over-the-counter markets, adjusted for non-performance risk. As such,

these derivative instruments are classified within level 2 in the fair value hierarchy.

The fair values of our derivative financial instruments are disclosed in note 8.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 7—Fair Value Measurements