Virgin Media 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

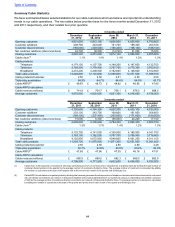

Cable

Our 'Collections' bundles introduced in April 2012 offer consumers differentiated products which are attractively

positioned versus our competitors, and are enabling us to capitalize on the increasing demand for superfast broadband

and, through our TiVo service, pay-TV growth.

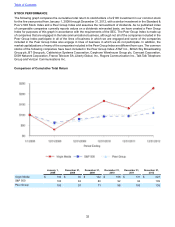

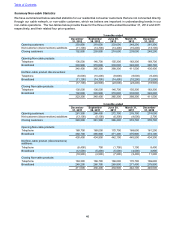

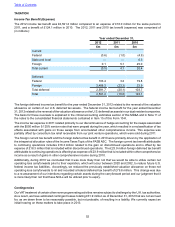

During 2012 we have seen an increase of 88,700 cable customers compared to an increase of 5,500 during 2011,

taking our total cable customers at December 31, 2012 to 4,894,000. Over this same period our total cable products

have increased by 248,100, compared to an increase of 47,100 in 2011. This growth is principally from new customers,

with the average number of cable products per customer remaining constant at 2.50 in 2012 and 2011. In 2011 cable

products per customer grew modestly to 2.50 from 2.49 in 2010.

Existing customers migrating from standard digital television to a TiVo service, or upgrading to superfast broadband,

together with selective price rises have been a key driver of increased revenues during 2012.

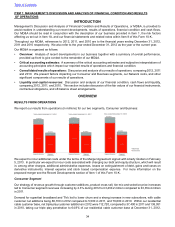

At December 31, 2012, 1,332,000 customers, or 35.1% of our TV customer base, were subscribing to our TiVo service,

compared to 435,100, or 11.6%, at December 31, 2011 following our launch of TiVo in December 2010. We launched

our Virgin TV Anywhere service in November 2012 which allows our TV customers to stream up to 45 live channels

to tablet computers and smartphones and access further content online, including thousands of hours of on-demand

programming. It also allows Virgin Media TiVo customers to connect to their TiVo boxes to manage their recordings

remotely.

Our superfast broadband customers, which we define as those subscribing to speeds of 30Mbit/s or above, increased

by 1.5 million during 2012, with the result that at December 31, 2012, 51% of our broadband customer base, or

2,175,800 customers, were receiving superfast broadband. Our program to double the broadband speeds of over 4

million customers announced in January 2012 is on track with 76% of our network having been upgraded by December

31, 2012. We expect the trend in customer demand for faster broadband speeds to continue, for example, 41% of

new broadband subscribers in the quarter ended December 31, 2012 took broadband speeds of 60Mbit/s or higher.

The success of our 'Collections' packages has also increased the number of customers taking a fixed line telephone

from us by 46,400 during 2012 to 4,179,100, compared to 4,132,700 and 4,161,700 at December 31, 2011 and 2010

respectively. As a result, triple-play penetration, which we define as those customers taking all three of our fixed line

telephone, broadband, and television products, increased to 64.9% at December 31, 2012, compared to 63.7% and

63.0% at December 31, 2011 and 2010 respectively.

We believe our product differentiation and attractive pricing has also driven the reduction in quarterly average monthly

churn, which for the quarter to December 31, 2012 fell to 1.1% compared to 1.3% in both of the quarters ended

December 31, 2011 and 2010.

The combination of increased customer numbers and improved product mix from new and existing customers discussed

above, together with a price rise implemented in April 2012, and partially offset by the continued decline in fixed line

telephony usage, has resulted in cable ARPU increasing by 2.1% to £48.87 in the quarter to December 31, 2012,

compared to £47.85 in the quarter to December 31, 2011. The increase in cable ARPU during 2011 to £47.85 for the

quarter to December 31, 2011 from £47.51 for the quarter to December 31, 2010 was due in part to selective price

increases and successful up-selling and cross selling to existing customers, partially offset by declining telephony

usage and price discounting.

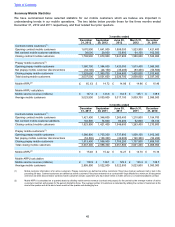

Mobile

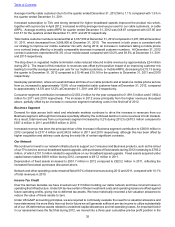

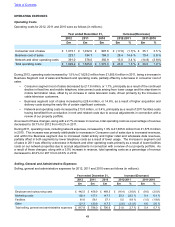

We have continued in 2012 with our strategy of using our own sales channels to improve mobile customer mix and

leveraging our cable customer base to cross sell mobile telephony services to existing cable customers. Quad-play

penetration, where a customer takes all three cable services and a mobile telephone service, increased to approximately

15.8% of our residential customer base at December 31, 2012 compared to approximately 14.5% at December 31,

2011, and 12.2% at December 31, 2010.

Total mobile customer numbers were flat at 3,037,500 at December 31, 2012 compared to 3,037,300 at December

31, 2011, reflecting the net effect of an improvement in our mobile customer mix during 2012 with 185,000 more

customers taking a mobile phone on a contract and a 184,800 fewer active prepay customers. During October 2012

we launched new all inclusive tariffs under our "Unlimitacular" advertising campaign which together with focusing

handset investment towards customer retention has driven the increase in contract customer numbers. The decrease

in prepay customers reflects the level of competition in the prepay market and our strategy of migrating prepay customers

to contracts due to lower churn and higher overall lifetime value of contract customers.

Table of Contents