Virgin Media 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-20

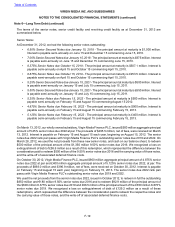

Convertible Senior Notes

On April 16, 2008, Virgin Media Inc. issued U.S. dollar denominated 6.50% convertible senior notes due 2016 with

a principal amount outstanding of $1,000 million. The convertible senior notes bear interest at an annual rate of

6.50% payable semi-annually on May 15 and November 15 of each year, beginning November 15, 2008. The

convertible senior notes mature on November 15, 2016 and may not be redeemed by us prior to their maturity date.

Upon conversion, we may elect to settle in cash, shares of common stock or a combination of cash and shares of

our common stock. Based on the December 31, 2012 closing price of our common stock, the 'if converted value' of

the convertible senior notes exceeds the outstanding principal amount by approximately £563.4 million.

If the trading price of our common stock exceeds 120% of the conversion price of the convertible notes for 20 out

of the last 30 trading days of a calendar quarter, holders of the convertible notes may elect to convert their convertible

notes during the following quarter. This condition was met in the three months ended December, 31 2012.

We have classified this debt as long term debt in the consolidated balance sheet as of December 31, 2012 because

we determined, in accordance with the Derivatives and Hedging Topic of the FASB ASC, that we have the ability to

settle the obligations in equity in all circumstances, except in the case of a fundamental change (as defined in the

indenture governing the convertible notes).

The liability and equity components of convertible debt instruments that may be settled in cash upon conversion

(including partial cash settlement) are required to be separately accounted for in a manner that reflects an issuer's

nonconvertible debt borrowing rate. As a result, the liability component is recorded at a discount reflecting its below

market coupon interest rate, and is subsequently accreted to its par value over its expected life, with the rate of

interest that reflects the market rate at issuance being reflected in the results of operations.

We have applied a non-convertible borrowing rate of 10.35% which resulted in the recognition of a discount on the

convertible senior notes totaling £108.2 million, with the offsetting amount recognized as a component of additional

paid-in capital. In addition, a cumulative translation adjustment of £36.1 million was recognized in relation to prior

periods due to the decrease in the foreign currency denominated debt balance subject to translation during 2008.

The equity component of the convertible senior notes was £108.2 million as of December 31, 2012 and 2011. The

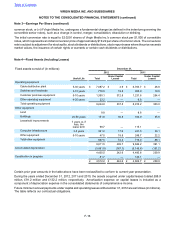

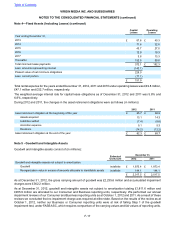

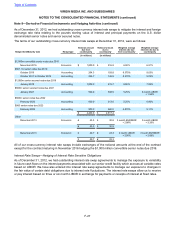

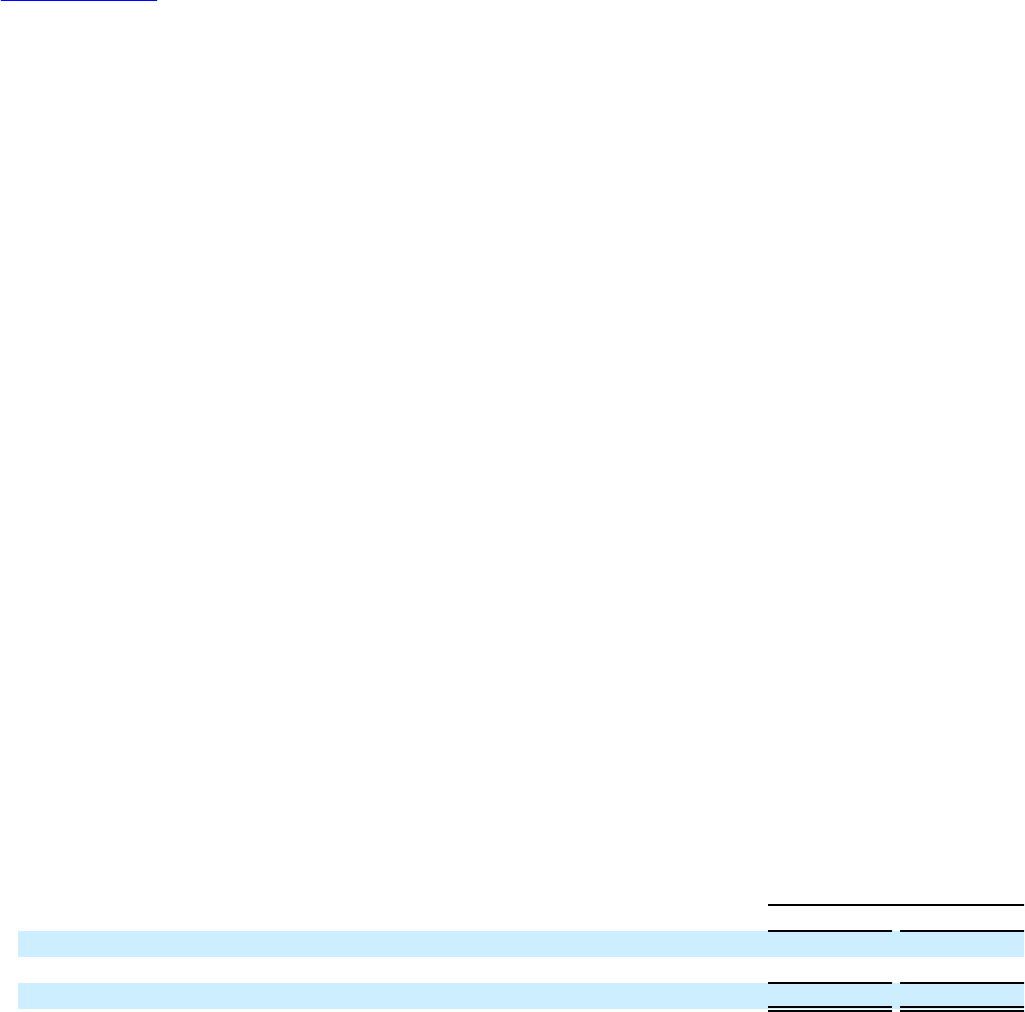

following table presents the principal amount of the liability component, the unamortized discount, and the net carrying

amount of our convertible debt instruments as of December 31, 2012 and 2011 (in millions):

December 31,

2012 2011

Principal obligation £ 617.7 £643.3

Unamortized discount (73.7)(92.2)

Net carrying amount £ 544.0 £551.1

As of December 31, 2012, the remaining discount will be amortized over a period of approximately 4 years. The

amount of interest cost recognized for the contractual interest coupon during the years ended December 31, 2012

and 2011 was approximately £41.0 million and £40.5 million, respectively. The amount of interest cost recognized

for the amortization of the discount on the liability component of the senior convertible notes for the years ended

December 31, 2012 and 2011 was £15.1 million and £13.5 million, respectively.

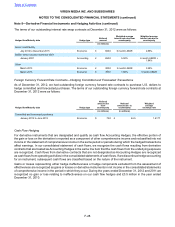

During 2010, we entered into capped call option transactions, or conversion hedges, with certain counterparties

relating to our convertible senior notes. The conversion hedges are intended to offset a portion of the dilutive effects

that could potentially be associated with conversion of the convertible senior notes at maturity. These conversion

hedges have an initial strike price of $19.22 per share of our stock, which is the conversion price provided under the

terms of our convertible senior notes, and a cap price of $35.00 per share of our stock. We paid £205.4 million for

the conversion hedges during the fourth quarter of 2010. The cost of these transactions was not deductible for U.S.

federal income tax purposes, and the proceeds, if any, received upon exercise of the options will not be taxable for

U.S. federal income tax purposes.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 6—Long Term Debt (continued)