Virgin Media 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

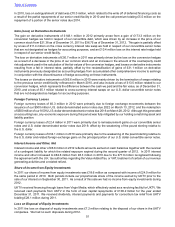

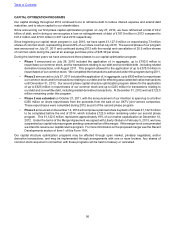

CAPITAL OPTIMIZATION PROGRAMS

Our capital strategy throughout 2012 continued to be to refinance debt to reduce interest expense and extend debt

maturities, and to return capital to our shareholders.

Since announcing our first phase capital optimization program on July 27, 2010, we have refinanced a total of £2.2

billion of debt, and in doing so we recognize a loss on extinguishment of debt of £187.8 million in 2012 compared to

£47.2 million and £70.0 million in 2011 and 2010 respectively.

Since beginning our capital return program in July 2010, we have spent £1,127.0 million on repurchasing 73 million

shares of common stock, representing around 22% of our share count at July 2010. The second phase of our program

was announced on July 27, 2011 and continued during 2012 with the receipt and cancellation of 20.5 million shares

of common stock during the year at an average purchase price of $25.39 per share.

During the last three years we have announced three phases to our capital optimization program:

• Phase 1 announced on July 28, 2010 included the application of, in aggregate, up to £700.0 million to

repurchase our common stock, and for transactions relating to our debt and convertible debt , including related

derivative transactions, until August 2011. This program allowed for the application of up to £375.0 million in

repurchases of our common stock. We completed the transactions authorized under this program during 2011.

• Phase 2 announced on July 27, 2011 included the application of, in aggregate, up to £850 million to repurchase

our common stock and for transactions relating to our debt and for effecting associated derivative transactions

until December 31, 2012. Our second phase capital structure optimization program allows for the application

of up to £625 million in repurchases of our common stock and up to £225 million for transactions relating to

our debt and convertible debt, including related derivative transactions. At December 31, 2012 we had £122.5

million remaining under this program.

• Phase 2 was extended on October 27, 2011, with the announcement of our intention to spend up to a further

£250 million on share repurchases from the proceeds from the sale of our UKTV joint venture companies.

These repurchases were completed during 2012 as part of the second phase program.

• Phase 3 announced on December 14, 2012 will comprise a planned share buyback of at least £1,122.5 million

to be completed before the end of 2014, which includes £122.5 million remaining under our second phase

program. This £1,122.5 million represents approximately 19% of our market capitalization at December 14,

2012. Under the terms of the Merger Agreement we signed with Liberty Global on February 5, 2013, we have

suspended our capital returns program pending consummation of the merger. If the merger is not consummated

we intend to resume our capital returns program. For more information on the proposed merger see the Recent

Developments section of Item 1 of this Form 10-K.

Our capital structure optimization programs may be effected through open market, privately negotiated, and/or

derivative transactions, and may be implemented through arrangements with one or more brokers. Any shares of

common stock acquired in connection with these programs will be held in treasury or cancelled.

Table of Contents