Virgin Media 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-81

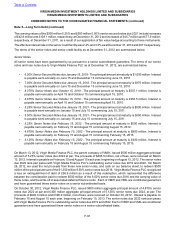

Note 1—Organization and Business

Virgin Media Investment Holdings Limited and its subsidiaries, or VMIH, and Virgin Media Investments Limited and its

subsidiaries, or VMIL, are indirect, wholly owned subsidiaries of Virgin Media Inc. incorporated in the United Kingdom.

VMIL is a direct, wholly owned subsidiary of VMIH.

On January 1, 2010, VMIL acquired VMIH’s shareholdings in its wholly owned subsidiaries other than Virgin Media

Secured Finance PLC, which remains a subsidiary of VMIH. VMIL issued an initial 1,000,141 shares to VMIH on

January 1, 2010 and an additional 1,489,994 shares on December 13, 2010 following the filing of the 2009 audited

financial statements of VMIH with the appropriate authorities in England and Wales as part of this internal reorganization.

As a result of the reorganization, it was determined that a change in reporting entity had occurred for VMIL and

accordingly the comparative separate financial statements for VMIL have been adjusted to consist of the combined

historical balance sheet, results of operations, and cash flows of the wholly owned subsidiaries of VMIH that were

contributed to VMIL as part of the group reorganization. These comparative financial statements have been prepared

in accordance with the guidance permissible for reorganizations between wholly owned subsidiaries such that the

historic values of all assets and liabilities acquired in the reorganization have been carried over with no new purchase

accounting considered. The effect of the issuances of common stock to VMIH has been retrospectively applied to the

shareholder’s equity amounts in the consolidated balance sheet as at December 31, 2009 to reflect these amounts

as if the transaction had occurred at the beginning of the periods presented. The retrospective application had no

material effect on other amounts. Intercompany accounts and transactions have been eliminated on consolidation.

Under the terms of the indentures governing the senior notes issued by Virgin Media Finance PLC and the indentures

governing the senior secured notes issued by Virgin Media Secured Finance PLC, VMIL was required to grant

guarantees that are identical to the guarantees granted by VMIH under the same indentures. Under the terms of the

intercreditor deed governing the senior credit facility, VMIL was required to grant a guarantee identical to the guarantee

granted by VMIH under the same deed. VMIH is fully dependent on the cash flows of the operating subsidiaries of

VMIL to service these debt obligations. As a result, debt obligations, cash required to service debt obligations, derivative

financial instruments, and any effects on the consolidated results of operations and cash flows related to the senior

notes, senior secured notes and senior credit facility have been reflected in the separate consolidated financial

statements of VMIL. As such, the amounts included in the financial statements of VMIL do not necessarily represent

items to which VMIL has legal title.

As used in these notes, the terms “we”, “our”, or “companies” refer to VMIH and VMIL and, except as otherwise noted,

the information in these combined notes relates to both of the companies.

We are a leading entertainment and communications business, being a “quad-play” provider of broadband internet,

television, mobile telephony and fixed line telephony services that offer a variety of entertainment and communications

services to residential and commercial customers throughout the U.K. We are one of the U.K.’s largest providers of

residential broadband internet, pay television and fixed line telephony services by number of customers. We believe

our advanced, deep fiber access network enables us to offer faster and higher quality broadband services than our

digital subscriber line, or DSL, competitors. As a result, we provide our customers with a leading next generation

broadband service and one of the most advanced TV on-demand services available in the U.K. market. As of

December 31, 2012, we provided services to 4.9 million residential cable customers on our network. We are also one

of the U.K.’s largest mobile virtual network operators by number of customers, providing mobile telephony service to

1.7 million contract mobile customers and 1.3 million prepay mobile customers over third party networks.

On February 5, 2013, Virgin Media Inc entered in to a Merger Agreement with Liberty Global, Inc., or Liberty Global,

and certain of its direct or indirect wholly owned subsidiaries, or the Merger Subsidiaries, pursuant to which they agreed,

through a series of intermediate steps and transactions, to be acquired by Liberty Global and merge into one of the

Merger Subsidiaries. If consummated, the merger will result in both Liberty Global and Virgin Media becoming directly

owned by a new U.K. public limited company, or the Ultimate Parent, listed on Nasdaq, the common stock of which

will in turn be held by Liberty Global and Virgin Media Shareholders. We will continue to operate under the Virgin

Media brand in the U.K.. Further details of the proposed merger are set out in Note 13 - Subsequent Events.

Table of Contents

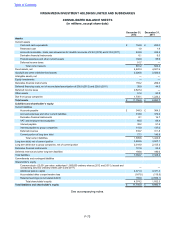

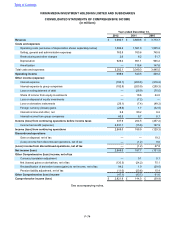

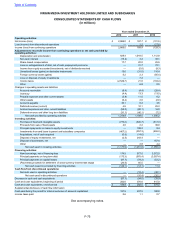

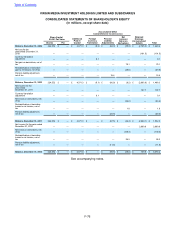

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS