Virgin Media 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-47

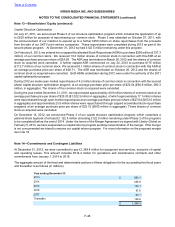

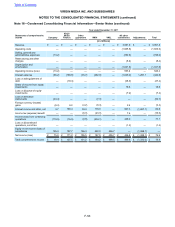

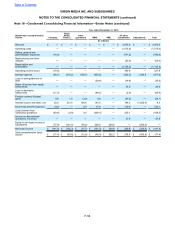

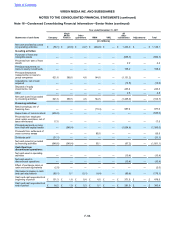

Purchase obligations in the table above represent amounts payable under fixed or minimum guaranteed commitments,

and therefore do not represent the total fees that are expected to be paid under certain programming contracts where

amounts payable are generally based on the number of customers receiving the programming.

This table excludes £668.9 million of accounts payable and accrued liabilities as at December 31, 2012 which will be

paid in 2013.

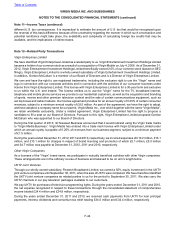

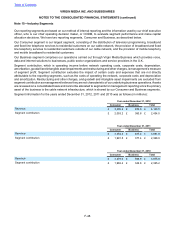

We are involved in lawsuits, claims, investigations and proceedings, consisting of intellectual property, commercial,

employee and employee benefits which arise in the ordinary course of our business. In accordance with the

Contingencies Topic of the FASB ASC, we recognize a provision for a liability when management believes that it is

both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. We believe

we have adequate provisions for any such matters. We review these provisions at least quarterly and adjust these

provisions to reflect the impact of negotiations, settlements, rulings, advice of legal counsel and other information and

events pertaining to a particular case. Additionally, when we believe it is at least reasonably possible that a liability has

been incurred in excess of any recorded liabilities we provide an estimate of the possible loss or range of loss or a

statement that such an estimate cannot be made. While litigation is inherently unpredictable, we believe that we have

valid defenses with respect to legal matters pending against us.

Our revenue generating activities are subject to VAT. During the second quarter of 2011, we reached an agreement

with the U.K. tax authorities regarding our VAT treatment of certain of these activities. The U.K. tax authorities provided

us with a refund of £81.5 million, which was collected during the second quarter of 2011, and £77.6 million of which is

included in interest income and other, net in the consolidated statement of comprehensive income for the year ended

December 31, 2011.

Our VAT treatment of certain other revenue generating activities remains subject to challenge by the U.K. tax authorities.

As a result, we have estimated contingent losses totaling £31.9 million as of December 31, 2012 that are not accrued

for, as we deem them to be reasonably possible, but not probable, of resulting in a liability. We currently expect an

initial hearing on these matters to take place in 2013.

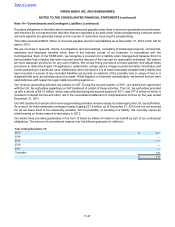

Our banks have provided guarantees in the form of stand by letters of credit on our behalf as part of our contractual

obligations. The amount of commitment expires over the following periods (in millions):

Year ending December 31:

2013 £ 4.7

2014 —

2015 1.7

2016 —

2017 —

Thereafter 0.6

£ 7.0

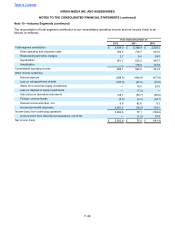

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 14—Commitments and Contingent Liabilities (continued)