Virgin Media 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-106

demand for data traffic that requires a high speed delivery mechanism like our fiber network and b) the

structure of the U.K. market.

• Consolidation in the industry has reduced the number of competitors since the years in which we incurred

significant losses.

• The industry is capital intensive and barriers to entry are high; therefore, we do not envision uneconomic

competition from new entrants.

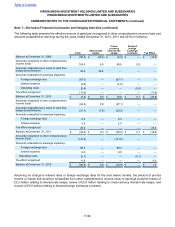

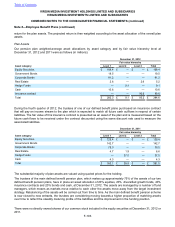

After consideration of these factors, we determined that it was unlikely that the losses incurred prior to the year ended

December 31, 2011 would be repeated and as a result, we did not place significant weight on the negative evidence

provided by our long history of losses.

We believe that our positive evidence is strong. The improving financial performance in recent years is an objectively

verifiable piece of positive evidence and is the result of a number of factors which have been present to a greater or

lesser extent in prior years but have only recently gathered sufficient weight to deliver objectively verifiable, consistent

taxable profits.

A key consideration in our analysis was that the unlimited carryforward periods of our U.K. tax assets make the

realization of those assets less sensitive to variations in our projections of future taxable income than would otherwise

be the case if the carryforward periods were time limited. In performing our analysis, we used the most updated plans

and estimates that we currently use to manage the underlying business and calculated the utilization of our deferred

tax assets under a number of scenarios. We do not require material increases in the current levels of cash flows, book

income, or taxable income to recover the value of our deferred tax assets other than capital losses.

The emergence from a cumulative loss position in the U.K. during 2012 was an important consideration in our

assessment and changed the balance of the remaining available evidence. While strong positive evidence was present

during 2011 and in earlier quarters of 2012, we concluded that the significance of the cumulative loss could not be

overcome prior to December 31, 2012. In the absence of the negative evidence provided by cumulative losses over

the most recent three year period, we believe that the available positive evidence outweighs the remaining negative

evidence. Therefore, we determined that it was appropriate to reverse substantially all of the valuation allowance on

our U.K. deferred tax assets other than capital losses. The reversal of the valuation allowance resulted an income tax

benefit of £2,428.4 million, during the year ended December 31, 2012, and an increase in current and non-current

deferred tax assets on the consolidated balance sheet for the year ended December 31, 2012. Beginning in the first

quarter of 2013, we expect our net income and earnings per share to be impacted to a greater degree by income tax

expense, which may fluctuate from period to period. However, this reversal will not result in any change to the amount

of cash payments to the U.K. tax authorities for income taxes.

Realization of our deferred tax assets is dependent on generating sufficient taxable income in future periods. Although

we believe it is more likely than not that future taxable income will be sufficient to allow us to recover substantially all

of the value of our U.K. deferred tax assets other than capital losses, realization is not assured and future events could

cause us to change our judgment. If future events cause us to conclude that it is not more likely than not that we will

be able to recover of the value of our deferred tax assets we would be required to establish a valuation allowance on

our deferred tax assets at that time, which would result in a charge to income tax expense and a material decrease

in net income in the period in which we change our judgment.

During 2012, we also reversed a valuation allowance on the U.S. deferred tax assets related to certain of our subsidiaries

that are considered dual resident in the U.K. and U.S. for tax purposes and recognized a benefit of £103.4 million.

The assets in these companies are principally comprised of NOLs. The companies have emerged from a cumulative

loss position and after consideration of all available positive and negative evidence we believe it is more likely than

not that the deferred tax assets will be utilized. Because those companies have emerged from a cumulative loss

position, significant negative evidence no longer exists. Positive evidence exists in the form of recent profitability,

forecasts for continued profitability, and long expiration periods for the NOLs. We do not require significant

improvements in the level of profitability to utilize the deferred tax assets prior to their expiration.

We have considered the implications of the proposed merger with Liberty Global, as discussed Note 13 - Subsequent

Events, on our accounting for our deferred tax assets. We note that a change in judgment that results in subsequent

recognition, derecognition, or change in measurement of a tax position taken in a prior annual period shall be recognized

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 9 - Income Taxes (continued)