Virgin Media 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

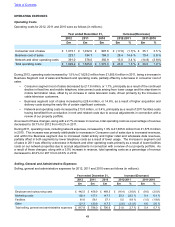

39

Negative evidence:

In the absence of a cumulative loss in the last three years, the remaining negative evidence consists solely of our long

history of significant pre-tax losses prior to 2011, dating back many years prior to the merger with Telewest in 2006.

In total, our U.K. group companies have approximately £386.1 million of deferred tax assets on £1,678.7 million of

NOLs which accumulated over many years. We believe that the combined impact of a number of company specific

and industry specific developments over recent years makes it unlikely that those historic losses will be repeated in

the future. These include:

Company specific factors:

• The significant investment associated with building our unique cable network does not need to be replicated.

Instead, we are able to spend relatively more modest sums to gradually upgrade and improve that network.

• We have established ourselves as one of the major telecommunication service providers in the U.K.,

offering leading next generation broadband and television services, which has enabled us to steadily and

economically grow revenues.

• Significant restructuring and rationalization activities subsequent to the Telewest merger have reduced

our cost base and focussed the business on its core activities. This allowed us to leverage our network

into financial returns and generate consistently improving operating margins.

• There has been a material improvement in our credit standing in recent years, including certain of our

debt being rated investment grade, which has allowed us to reduce and lock-in lower interest rates.

Industry specific factors:

• The cable and telecommunications markets have matured since the late 1990s and early 2000s.

• There is only one competitor in the U.K. with a substantial fiber network.

• Pricing in the U.K. telecommunications market in recent years is considerably more rational than in the

early to mid portion of the previous decade. We expect that trend to continue given a) the increase in

demand for data traffic that requires a high speed delivery mechanism like our fiber network and b) the

structure of the U.K. market.

• Consolidation in the industry has reduced the number of competitors since the years in which we incurred

significant losses.

• The industry is capital intensive and barriers to entry are high; therefore, we do not envision uneconomic

competition from new entrants.

After consideration of these factors, we determined that it was unlikely that the losses incurred prior to the year ended

December 31, 2011 would be repeated and as a result, we did not place significant weight on the negative evidence

provided by our long history of losses.

We believe that our positive evidence is strong. The improving financial performance in recent years is an objectively

verifiable piece of positive evidence and is the result of a number of factors which have been present to a greater or

lesser extent in prior years but have only recently gathered sufficient weight to deliver objectively verifiable, consistent

taxable profits.

A key consideration in our analysis was that the unlimited carryforward periods of our U.K. tax assets make the

realization of those assets less sensitive to variations in our projections of future taxable income than would otherwise

be the case if the carryforward periods were time limited. In performing our analysis, we used the most updated plans

and estimates that we currently use to manage the underlying business and calculated the utilisation of our deferred

tax assets under a number of scenarios. We do not require material increases in the current levels of cash flows, book

income, or taxable income to recover the value of our deferred tax assets other than capital losses.

The emergence from a cumulative loss position in the U.K. during 2012 was an important consideration in our

assessment and changed the balance of the remaining available evidence. While strong positive evidence was present

during 2011 and in earlier quarters of 2012, we concluded that the significance of the cumulative loss could not be

overcome prior to December 31, 2012. In the absence of the negative evidence provided by cumulative losses over

Table of Contents