Virgin Media 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Our senior unsecured notes are issued by VMF and are guaranteed on a senior basis by Virgin Media Inc., Virgin

Media Group LLC, Virgin Media Holdings Inc., Virgin Media (UK) Group, Inc. and Virgin Media Communications Limited

and on a senior subordinated basis by VMIH and VMIL. Interest accrues from date of issuance.

Senior Secured Notes

Our wholly owned subsidiary Virgin Media Secured Finance PLC, or VMSF, has issued senior secured notes in a mix

of U.S. dollar and Sterling denominated instruments:

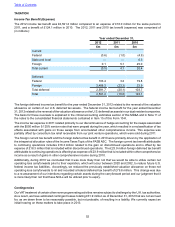

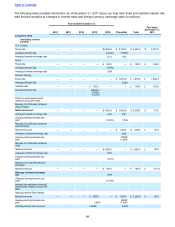

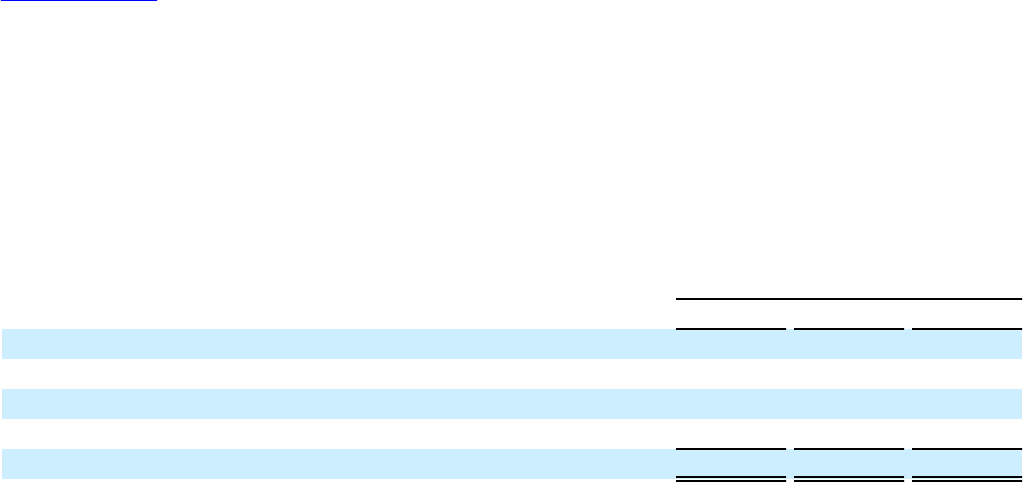

Carrying value (£ million)

Senior secured notes Issue date Annual interest date 2012 2011 2010

$1,000m 6.50% U.S. dollar due Jan 15, 2018 January 19, 2010(1) June 15th & Dec 15th £ 611.2 £635.4 £632.3

£875m 7.00% Sterling due Jan 15, 2018 January 19, 2010(1) June 15th & Dec 15th 865.9 864.5 863.1

$500m 5.25% U.S. dollar due Jan 15, 2021 March 3, 2011(2) Jan 15th & July 15th 350.5 353.1 —

£650m 5.50% Sterling due Jan 15, 2021 March 3, 2011(2) Jan 15th & July 15th 754.1 722.4 —

Total senior secured notes £ 2,581.7 £ 2,575.4 £1,495.4

(1) On August 5, 2010, we completed an offer to exchange any and all of the then outstanding senior secured notes due 2018, which we

originally issued in a U.S. private placement, for an equivalent amount of new senior secured notes due 2021 which have been registered under

the U.S. Securities Act of 1933, as amended.

(2) On September 8, 2011, we completed an offer to exchange any and all of the then outstanding senior secured notes due 2018, which we

originally issued in a U.S. private placement, for an equivalent amount of new senior secured notes due 2021 which have been registered under

the U.S. Securities Act of 1933, as amended.

We have entered in to cross currency interest rate swaps to mitigate the interest and foreign exchange risks associated

with our U.S. dollar denominated debt, which for these senior secured notes due 2018 and 2021 changes the weighted

average interest rate to 7.02% and 6 month LIBOR +1.94% respectively.

No senior secured notes have been issued or amended during 2012 with the reduction in the weighted average interest

rate from 5.46% to 5.43% being due to reductions in LIBOR.

In 2011 the weighted average interest rate on our senior secured notes fell from 7.01% in 2010 to 5.46% in 2011,

principally as a result of issuing the senior secured notes due 2021 with a lower coupon than the senior notes due

2018. During March 2011, the net proceeds from issuing the senior secured notes due 2021 were partly applied

against amounts outstanding under our senior credit facility at that date.

Our senior secured notes are issued by VMSF and are guaranteed on a senior basis by Virgin Media Inc., Virgin Media

Group LLC, Virgin Media Holdings Inc., Virgin Media (UK) Group, Inc. and Virgin Media Communications Limited and

on a senior subordinated basis by VMIH and VMIL. They also rank pari passu with and, subject to certain exceptions,

share in the same guarantees and security which has been granted in favor of our senior credit facility.

Senior Credit Facilities

Our senior credit facilities comprise a term loan, which can be used for general corporate purposes, and a revolving

credit facility, or RCF, for the financing of our ongoing working capital requirements and general corporate purposes.

Since May 20, 2011, £750 million has been available under the term loan facility, which was fully drawn at December

31, 2012, and £450 million is available under the RCF. At December 31, 2012 £6.4 million of the RCF had been utilized

for bank guarantees & letters of credit provided in the usual course of business. On June 28, 2012, we borrowed

£100.0 million under the RCF, which was repaid in full on September 28, 2012. On November 30, 2012 we borrowed

£75.0 million under the RCF, which was repaid in full on December 31, 2012. As at December 31, 2012, £443.6 million

was available to be drawn under the RCF.

Interest on our senior credit facility is payable at least semi-annually based on LIBOR plus an applicable interest margin

depending on the total net leverage ratio of the bank group. The interest margin is between 1.625% and 2.125% for

the term loan, and between 1.325% and 2.125% for the RCF. We have entered in to interest rate swap agreements

to manage our exposure to variability in LIBOR, which from July 2012 to December 2015 have swapped interest

receipts based on six month LIBOR for interest payments at fixed rates of between 2.79% and 2.91%.

Prior to May 20, 2011, our Senior Facilities Agreement, or SFA, comprised an original term loan in two Tranches, A

and B, and a revolving credit facility, as set out in our Form 10-K for the year ended December 31, 2011.

Table of Contents