Virgin Media 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-45

Authorized Share Capital

Our authorized share capital for issuance consists of one billion shares of common stock, 300 million shares of Class B

redeemable common stock and five million shares of preferred stock with a par value of $0.01 each. As at December 31,

2012 there were 269.3 million shares of common stock outstanding, and no Class B redeemable common stock or

preferred stock outstanding. The common stock is voting with rights to dividends as declared by the Board of Directors.

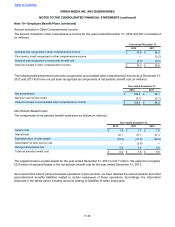

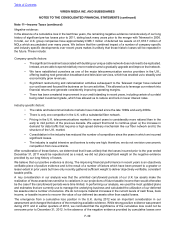

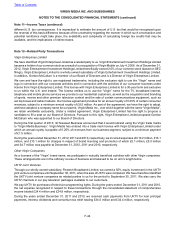

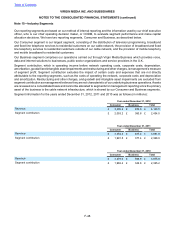

The following table summarizes the movement in the number of shares of common stock outstanding during the years

ended December 31, 2012, 2011 and 2010 (in millions):

Number of

shares

December 31, 2009 outstanding shares 330.8

Net issuances and purchases during the period (8.8)

December 31, 2010 outstanding shares 322.0

Net issuances and purchases during the period (35.3)

December 31, 2011 outstanding shares 286.7

Net issuances and purchases during the period (17.4)

December 31, 2012 outstanding shares 269.3

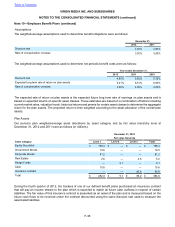

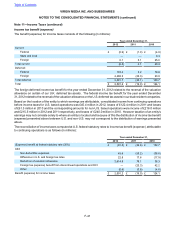

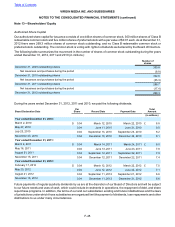

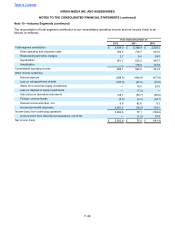

During the years ended December 31, 2012, 2011 and 2010, we paid the following dividends:

Board Declaration Date Per

Share Record Date Payment Date Total

Amount

(in millions)

Year ended December 31, 2010:

March 2, 2010 $ 0.04 March 12, 2010 March 22, 2010 £ 8.8

May 27, 2010 0.04 June 11, 2010 June 21, 2010 9.0

July 23, 2010 0.04 September 13, 2010 September 23, 2010 8.2

November 23, 2010 0.04 December 13, 2010 December 23, 2010 8.1

Year ended December 31, 2011:

March 4, 2011 $ 0.04 March 14, 2011 March 24, 2011 £ 8.0

May 16, 2011 0.04 June 13, 2011 June 23, 2011 7.8

August 31, 2011 0.04 September 12, 2011 September 22, 2011 7.9

November 15, 2011 0.04 December 12, 2011 December 22, 2011 7.4

Year ended December 31, 2012:

February 17, 2012 $ 0.04 March 12, 2012 March 22, 2012 £ 7.0

May 23, 2012 0.04 June 12, 2012 June 22, 2012 7.1

August 21, 2012 0.04 September 11, 2012 September 21, 2012 6.6

November 16, 2012 0.04 December 11, 2012 December 21, 2012 6.6

Future payments of regular quarterly dividends by us are at the discretion of our Board of Directors and will be subject

to our future needs and uses of cash, which could include investments in operations, the repayment of debt, and share

repurchase programs. In addition, the terms of our and our subsidiaries’ existing and future indebtedness and the laws

of jurisdictions under which those subsidiaries are organized limit the payment of dividends, loan repayments and other

distributions to us under many circumstances.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 13—Shareholders' Equity