Travelers 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

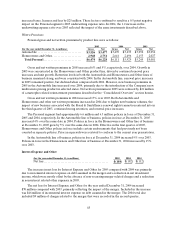

Net Investment Income

Refer to the “Net Investment Income” section of the “Consolidated Results of Operations” discussion

herein for a description of the factors contributing to the increase in the Company’s net investment income

in 2005and 2004.

Claims and Expenses

Claims and claim adjustment expenses in 2005 included catastrophe losses of $547 million, compared

with catastrophe losses of $189 million in2004. Catastrophe losses in both years were primarily driven by

the hurricanes described in the “Consolidated Overview” section herein. Net favorable prior year reserve

development in 2005 was $360 million, compared with net favorable prior year reserve development of

$378 million in 2004. The favorable prior year development in2005 and 2004 was primarily driven by

further declines in the frequency of non-catastrophe losses and lower than expected severity resulting from

recent claim initiatives. The favorable development inboth years also reflected the recognition of lower

current accident year frequency of non-catastrophe related claims in the Homeowners and Other line of

business and an improvement in frequency trends in the Automobile line of business.

Catastrophe losses in 2004 of $189 million were $60 million less than the 2003 catastrophe loss total of

$249 million. The 2003 losses resulted from a variety of storms across the United States, including

Hurricane Isabel in the third quarter of the year and wildfires in California. Favorable prior year reserve

development of $378 million in 2004 was significantly higher than favorable prior year development of

$212 million in 2003. The favorable 2003 development was also primarily due to lower than expected

frequency of non-catastrophe related homeowners’ losses. The 2003 total also included a $50 million

reduction in losses resulting from the September 11, 2001 terrorist attack.

General and administrativeexpenses totaled $665 million in2005, $536 million in 2004 and

$420 million in 2003. The 2005 total included $25 million of catastrophe-related assessments. The increases

in both 2005 and 2004 reflected business growth and agent profit-sharing expenses related to profitable

underwritingresults. In addition, the increases in both years reflected investments in personnel, technology

and infrastructure to support business growth, and continued process re-engineering pilots targeted to

reduce loss severity.

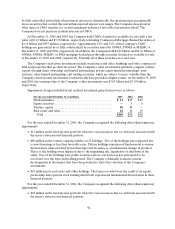

GAAP Combined Ratio

The loss and loss adjustment expense ratio for 2005 included a 9.3 point impact from catastrophe

losses, whereas the comparable 2004 ratio included a 3.4 point impact from catastrophe losses. The impact

from net favorable prior year reserve development in 2005 was 6.0 points, compared with6.8 points in

2004. Excluding the impact of these factors in both years, the 2005 loss and loss adjustment expense ratio

was 2.8 points better than the 2004 ratio, reflectingimprovement in current accident year non-catastrophe

loss experience. The 2003 loss and loss adjustment expense ratio of 69.1 included a 5.2 point impact of

catastrophe losses and a 4.4 point benefit from net favorable prior year reserve development. Excluding

these factors from both 2004 and 2003, the loss andloss adjustment expense ratio in 2004 improved

significantly over 2003, reflecting the earned impact of price increases that continued to exceed loss cost

trends and improvement in non-catastrophe loss frequency.

The 2.0 point increase in the underwriting expense ratio in 2005 compared with 2004 reflected an

increase in commission expenses, other insurance expenses, and taxes, licenses and fees. The increase in

commissions reflected a changing product mix and higher agent profit sharing expenses. The increase in

other insurance expenses reflected the impact of continued process re-engineering investments and

investments in personnel, technology and infrastructure to support business growth and product

development. In addition, reinstatement premiums related to the catastrophe losses reduced earned

premium volume by $21 million in 2005, and catastrophe-related assessments from various insurance pools