Travelers 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258

|

|

40

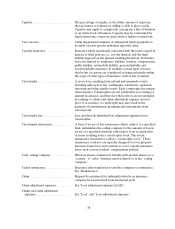

Fidelity and surety programs......... Fidelity insurance coverage protects an insured for loss due to

embezzlement or misappropriation of funds by an employee.

Surety is a three-party agreement in which the insurer agrees to

pay a second party or make complete an obligation in response

to the default, acts or omissions of an insured.

Guaranteed cost products ........... An insurance policy where the premiums charged will not be

adjusted for actual loss experience during the covered period.

Guaranty fund ..................... State-regulated mechanismwhich is financed by assessing

insurers doing business in those states. Should insolvencies

occur, these funds are available to meet some or all of the

insolvent insurer’s obligations to policyholders.

Incurred but not reported (IBNR)

reserves ......................... Reserves for estimated losses and LAE that have been incurred

but not yet reported to the insurer. This includes amounts for

unreported claims, development on known cases, and re-opened

claims.

Inland marine. ..................... A broad type of insurance generally covering articles that may

be transported from one place to another, as well as bridges,

tunnels and other instrumentalities of transportation. It includes

goods in transit, generally other than transoceanic, and may

include policies for movable objects such as personal effects,

personal property, jewelry, furs, fine art and others.

IRIS ratios........................ Financial ratios calculated by the NAIC to assist state insurance

departments in monitoring the financial condition of insurance

companies.

Large deductible policy ............. An insuranc epolicy where the customer assumes at least

$25,000 or more of each loss. Typically, the insurer is

responsible for paying the entire loss under those policies and

then seeks reimbursement from the insured for the deductible

amount.

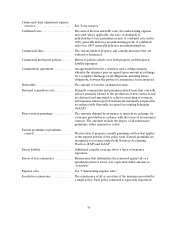

Lloyd’s. ........................... An insurance marketplace based in London, England,where

brokers, representing clients with insurable risks, deal with

Lloyd’s underwriters, who represent investors. The investors are

grouped together into syndicates that provide capital to insure

the risks.

Loss .............................. An occurrence that is the basis forsubmission and/or payment

of a claim. Losses may be covered, limited or excluded from

coverage, depending on the terms of the policy.

Loss adjustment expenses (LAE)..... The expenses of settling claims, includinglegal and other fees

and the portion of general expenses allocated to claim

settlement costs.