Travelers 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Company’s Gulf subsidiary. The 2004 total also included $761million of catastrophe losses (net of

reinsurance), compared with catastrophe losses of $352 million in 2003.

Cost o f Catastrophes. The Company’s cost of catastrophes, net of reinsurance and including

reinstatement premiums and state assessments, totaled $2.19 billion in 2005, primarily resulting from

Hurricanes Katrina, Rita and Wilma. Hurricane Katrina made landfall in Florida, Louisiana, Mississippi

and Alabama in August 2005, Hurricane Rita made landfall in Texas and Louisiana in September 2005 and

Hurricane Wilma made landfall in Florida in October 2005. In 2004, the cost of catastrophes, net of

reinsurance, totaled $772 million, all of which resulted from four hurricanes—Charley, Frances, Ivan and

Jeanne—that also made landfall in thesoutheastern United States. In 2003, Hurricane Isabel and several

storms across the United States accounted for the majority of the $352 million cost of catastrophes. The

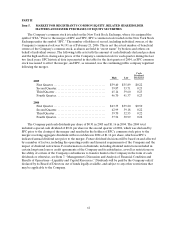

cost of catastrophes was included in the Company’s business segments in the respective periods as follows:

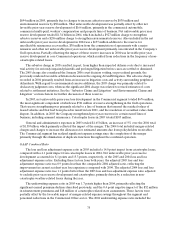

(for the year ended December 31, in millions) 2005 2004 2003

Commercial........................................... $1,240 $363 $103

Specialty .............................................. 356 220 —

Personal .............................................. 593 189 249

Total............................................... $2,189 $772 $352

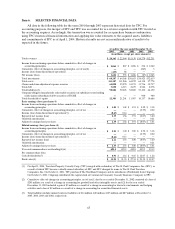

The following table provides additional information regarding the components of the estimated cost

recorded related to catastrophes in 2005.

(for the year ended December 31, in millions)

Gross loss and loss adjustment expenses ............................... $3,811

Reinstatement premiums............................................ 121

State assessments ................................................... 43

Reinsurance recoverables ............................................ (1,786 )

Total estimated pretax loss......................................... $2,189

Reinstatement premiums represent additional premiums payable to reinsurers to restore coverage

limits that have been exhausted as a result of reinsured losses under certain excess-of-loss reinsurance

treaties and are recorded as a reduction of net written and earned premiums. After payment of these

reinstatement premiums, the Company has coverage for one additional limit under its corporate

catastrophe treaty and continuing protection under most of its other treaties. The term of the Company’s

current corporate catastrophe treaty expires on June 30, 2006. State assessments are recorded as a

component of general and administrativeexpenses.

General and AdministrativeExpenses

The $284 million increase in general and administrative expenses in 2005 compared with 2004

primarily reflected the impact of the merger. In addition, the 2005 total included $43 million of state

assessments related to catastrophe losses, and also reflected investments made for process re-engineering

and to support business growth and product development, primarily in the Personal segment. These factors

were partially offset by the benefit of expense efficiencies achieved since the completion of the merger.

The Commercial segment in particular has realized significant expense savings since the completion of the

merger primarily through the elimination of duplicate functions throughout the combined organization.

Included in the 2005 and 2004 totals were $112 million and $92 million, respectively, of amortization

expense related to finite-lived intangible assets acquired in the merger, and a benefit of $12 million and

$58million, respectively, associated with the accretion of the fair value adjustment to claims and claim

adjustment expenses and reinsurance recoverables. The 2004 total included a $62 million increase in the

allowance for uncollectible amounts due from policyholders for loss-sensitive business (primarily high-

deductible business). This increase resulted from applying the Company’s credit-based methodology for