Travelers 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

the large account sector, as described inmore detail in the Commercial segment discussion that follows. In

2004, the 26% increase in fee income reflected higher new business levels resulting, in part, from athird

quarter 2003 renewal rights transaction, as well as renewal price increases and an increase in workers’

compensation business written through state residual market pools.

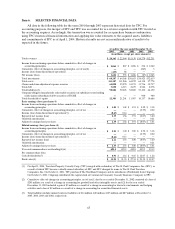

Net Realized Investment Gains (Losses)

Net pretax realized investment gains in 2005 totaled $17 million, primarily generated from sales of

venture capital investments and equity securities. In addition, the Company realized a pretax gain of

$21 million from the sale of its Personal Catastrophe Risk operation and $13 million of pretax net gains

related to U.S. Treasury futures contracts which are marked to market and settled daily. Net realized

investment gains in 2005 were reduced by $109 million of impairment losses, which were concentrated in

the venture capital portfolio as described in more detail later in this discussion.

The Company’s net pretax realized investment losses of $39 million in 2004 included impairment

charges totaling $80 million, whereas net pretax realized gains of $38 millionin 2003 included $90 million

of impairment charges. Net pretax realized investmentgains (losses) in 2004 and 2003 also included net

losses of $44 million and $27 million, respectively, related to U.S. Treasury futures contracts. Further

information regarding the nature of impairment charges in each year is included in the “Critical

Accounting Estimates” section later in this discussion.

Other Revenues

Other revenues in all periods presented primarily consist of premium installment charges.

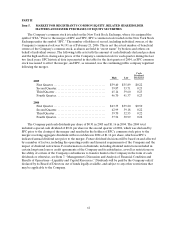

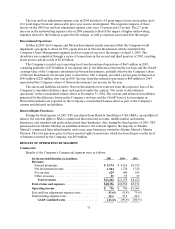

Written Premiums

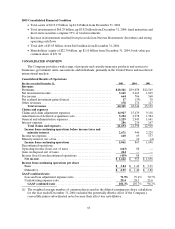

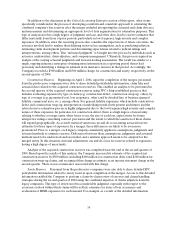

Consolidated gross and netwritten premiums were as follows:

2005 2004 2003

(for the year ended December 31, in millions) Gross Net Gross Net Gross Net

Commercial......................... $ 1 0,426 $ 8,429 $ 1 0,636 $ 8,311 $ 8,668 $ 6,862

Specialty ............................ 6,836 5,729 5,511 4,771 1,457 1,258

Personal ............................ 6,474 6,228 6,111 5,929 5,245 5,081

Total ............................. $ 2 3,736 $ 2 0,386 $ 2 2,258 $ 1 9,011 $ 15,370 $ 1 3,201

Gross and net written premiums in 2005 both increased 7% over 2004, primarily reflecting the impact

of the merger. However, gross and net written premium volumes in 2005 were down when compared to

2004 on a pro forma combined basis. The declines were concentrated in the Commercial segment,

reflecting the planned non-renewal of business in runoff and reduced premium volume in ongoing

operations due to increasingly competitive market conditions. In addition, premium volume in the

Specialty segment’s Construction operationwas lower than in 2004 on a pro forma basis due to the now-

completed process of aligning the underwriting profile of the two predecessor companies. Net written

premiums in 2005 were reduced by $121 million of reinstatement premiums related to catastrophe losses

discussed later in this narrative, whereas 2004 net written premium volume was reduced by $76 million of

reinstatement premiums primarily related to reserving actions in the Specialty segment. However,

premium volume in the Personal segment increased over 2004, driven by continued renewal price increases

and unit growth in thehomeowners lineof business. During 2005, the Company experienced strong

retention levels on a company-wide basis,as the Company focused on retaining its existing book of well

priced, profitable business. New business levels in several of the Company’s insurance operations also

increased over 2004. Rate increases, however, were generally lower in 2005 compared with 2004, reflecting

increased competition and more aggressive pricing in the marketplace. Rates for certain products in

selected markets declined from 2004 levels.