Travelers 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

The Company’s discussions related to all items, other than net income, income from continu ing

operations, income (loss) from discontinued operations, and segment operating income (loss), are

presented on a pretax basis, unless otherwise noted. Throughout the following discussion, the Company

references the “impact of the merger,” which in the context of a comparison between 2005 and 2004 refers

to the Company’s 2005 results reflecting a full year of combined post-merger operations, whereas the

Company’s 2004 results reflect combined post-merger operations for the nine months subsequent to the

April 1, 2004 merger date, plus the results of TPC only for the three months ended March 31, 2004. In the

context of a comparison between 2004 and 2003, the “impact of the merger” refers to the Company’s 2004

results reflecting the components described above, whereas the Company’s 2003 results include the results

of TPC only for the full year.

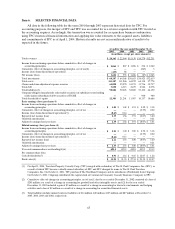

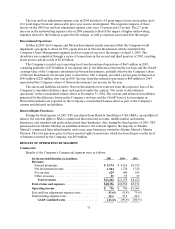

Overview

Income from continuingoperations in 2005 totaled $2.06 billion, or $2.95 per share diluted, compared

with income from continuing operations of $867 million, or $1.40 per share diluted, in 2004. The increase

in income in 2005 reflected the impact of the merger, improved non-catastrophe current year loss

experience in the Company’s three business segments, a decline in net unfavorable prior year reserve

development and strong growth in net investment income. These factors more than offset a significant

increase in the cost of catastrophes (including reinstatement premiums and state assessments), which

totaled $2.19 billion in 2005, compared with $772 million in2004. Catastrophe losses in 2005 primarily

related to Hurricanes Katrina, Rita and Wilma, as described in more detail in the following narrative. Net

unfavorable prior year reserve development in 2005 totaled $325 million, compared with net unfavorable

prior year reserve development of $2.39 billion in 2004. The 2005 total was driven by a charge of

$830 million to strengthen asbestos reserves as a result of the Company’s annual asbestos liability review,

which was partially offset by other non-asbestos related net favorable prior year reserve development in

the Personal and Commercial segments. The net unfavorable prior year reserve development in 2004 total

was the result of several significant reserve charges recorded subsequent to the merger and which are

discussed in more detail in the following narrative.

In 2005, the Company sold its equity interest in Nuveen Investments, which constituted its Asset

Management segment. The Company recorded a net loss from discontinued operationsof $439 million in

2005, consisting primarily of $710 million of tax expense which resulted from the difference between the

tax basis and the GAAP carrying value of the Company’s investmentin Nuveen Investments, partially

offset by the $224 million after-tax gain on the divestiture and the Company’s share of Nuveen

Investments’ net income for 2005. Income from discontinued operations of $88 million in 2004 represented

the Company’s share of Nuveen Investments’ net income for the year.

Income from continuingoperations in 2004 totaled $867 million, or $1.40 per share diluted, compared

with $1.70 billion, or $3.80 per share diluted, in 2003. The $829 million decline in 2004 compared with 2003

wasdriven by $2.39 billion of net unfavorable prior-year reserve development. That net unfavorable prior

year reserve development in 2004 was concentrated in the Commercial and Specialty segments and was

primarily comprised of $928 million to strengthen asbestos reserves as a result of the completion of the

Company’s annual asbestos liability review, merger-related reserve strengthening of $500 million for

construction and $300 million for surety, $290million to strengthen environmental reserves, $252 million

related to the financial condition of a specific construction contractor and $113 million related to the

commutation of agreements with a major reinsurer. These charges are described in more detail in the

following segment discussions. In addition, 2004 income from continuing operations included $296 million

of pretax charges to increase the allowance for estimated amounts due from reinsurance recoverables,

policyholder receivables and co-surety participations on a specific construction contractor claim. Net

unfavorable reserve development in the Commercial and Specialty segments in 2004 more than offset

additional income resulting from the merger and strongoperating income generated by the Company’s

Personal segment. In addition, the cost of catastrophes in 2004 of $772 million was $420 million higher