Travelers 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

insured program and, to a lesser extent, a retrospectively rated or a guaranteed cost insurance policy.

Through a network of field offices, the Company’s underwriting specialists work closely with national and

regional brokers to tailor insurance programs to meet clients’ needs. Workers’ compensation accounted for

approximately 76% of sales to National Accounts customers during2005, based on direct written

premiums and fees. National Accounts generated $405 million of fee income in 2005, excluding

commercial residual market business discussed below.

National Accounts also includes the Company’s commercial residual market business. The Company’s

commercial residual market business sells claims and policy management services to workers’

compensation and automobile assigned risk plans and to self-insurance pools throughout the United

States. The Company services approximately 36% of the total workers’ compensation assigned risk market.

The Company is one of only two servicing carriers that operate nationally. Assigned risk plan contracts

generated approximately $203 million infee income in 2005.

National Accounts also includes the Company’s Discover Re operation, which principally provides

commercial auto liability, general liability, workers’ compensation and property coverages. It serves retail

brokers and insureds who utilize programs such as self-insurance, collateralized deductibles and captive

reinsurers.

Commercial Other includes the Special Liability Group (which manages the Company’s asbestos and

environmental liabilities); the assumed reinsurance, health care, and certain international runoffand other

operations; and Gulf, which was placed into runoff during the second quarter of 2004. Certain business

previously written by Gulf is now being written in Commercial Accounts and in the Company’s Specialty

segment. Gulf provided specialty coverages including management and professional liability, excess and

surplus lines, environmental, umbrella and fidelity. Gulf also provided insurance products specifically

designed for financial institutions, the entertainment industry and sports organizations.

Pricing and Underwriting

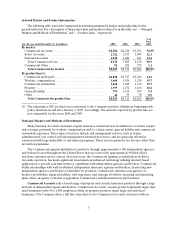

Pricing levels for Commercial property and casualty insurance products are generally developed based

upon an expectation of estimated losses, the expenses of producing business and managing claims, and a

reasonable allowance for profit. Commercial has a disciplined approach to underwriting and risk

management that emphasizes profitable growth rather than premium volume or market share.

Commercial has developed an underwriting and pricing methodology that incorporates underwriting,

claims, engineering, actuarial and product development disciplines for particular industries. This approach

is designed to maintain high quality underwriting and pricing discipline. It utilizes proprietary data

gathered and analyzed with respect to its Commercial business over many years. The underwriters and

engineers use this information to assess and evaluate risks prior to quotation. This information provides

specialized knowledge about specific industry segments. This methodology enables Commercial to

streamline its risk selection process and develop pricing parameters that will not compromise

Commercial’s underwriting integrity.

For smaller businesses, Select Accounts uses a process based on industry classifications to allow agents

and field underwriting representatives to make underwriting and pricing decisions within predetermined

classifications, because underwriting criteria and pricing tend to be more standardized for these smaller

exposures.

A significant portion of Commercial business is written with large deductible insurance policies.

Under workers’ compensation insurance contracts with deductible features, the Company is obligated to

pay the claimant the full amount of the claim. The Company is subsequently reimbursed by the

contractholder for the deductible amount, and is subject to credit risk until such reimbursement is made.

At December 31, 2005, contractholder receivables and payables on unpaid losses associated with large