Travelers 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

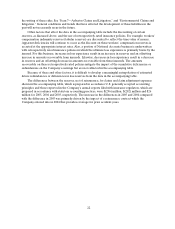

The Company derives estimates for unreported claims and development on reported claims

principally from actuarial analyses of historical patterns of loss development by accident year for each type

of exposure and business unit. Similarly, the Company derives estimates of unpaid loss adjustment

expenses principally from actuarial analyses of historical development patterns of the relationship of loss

adjustment expenses to losses for each line of business and type of exposure. For a description of the

Company’s reserving methods for asbestos and environmental claims, see “Item 7—Asbestos Claims and

Litigation,” and “Environmental Claims and Litigation.”

Discounting

Included in the claims and claim adjustment expense reserves in the consolidated balance sheet are

certain reserves discounted to the present value of estimated future payments. The liabilities for losses for

some long-term disability payments under workers’ compensation insurance and workers’ compensation

excess insurance, which totaled $1.92 billion and $1.99 billionat December 31, 2005 and 2004, respectively,

were discounted using a rate of 5% at December 31, 2005 and a range of rates from 3.5% to 5% at

December 31, 2004. Reserves related to certain fixed and determinable asbestos-related settlements, where

all payment amounts and their timing are known, totaled $34 million and $67 million at December 31, 2005

and 2004, respectively. These reserves were discounted using a rate of 2.6% at December 31, 2005, and at a

range of rates from 2.3% to 2.6% at December 31, 2004. Reserves for certain assumed reinsurance

business were discounted using a range of rates from 5% to 7.5%, and totaled $79 million and $126 million

at December 31, 2005 and 2004, respectively.

Other Factors

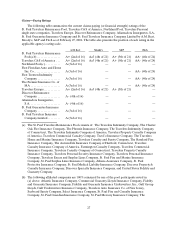

The table on page 23 sets forth the year-end reserves from 1995 through 2005 and the subsequent

changes in those reserves, presented on a historical basis. The original estimates, cumulative amounts paid

and reestimated reserves in the table for the years 1995 through2003 have not been restated to reflect the

acquisition of SPC in 2004. The table includes SPC reserves beginning at December 31, 2004.

The original estimates, cumulative amounts paid and reestimated reserves in the table for the years

1995 to 2000 have also not been restated to reflect the acquisition of Northland and Commercial Guaranty

Casualty, and the year 1995 in the table has not been restated to reflect the acquisition of Aetna’s property

and casualty insurance subsidiaries. Beginning in 1996 and 2001, the table includes the reserve activity of

Aetna’s property and casualty insurance subsidiaries, and Northland and Commercial Guaranty Casualty,

respectively. The data in the table is presented in accordance with reporting requirements of the Securities

and Exchange Commission(SEC). Care must be taken to avoid misinterpretation by those unfamiliar with

this informationor familiar with other data commonly reported by the insurance industry. The

accompanying data is not accident year data, but rather a display of 1995 to 2005 year-end reserves and the

subsequent changes in those reserves.

For instance, the “cumulative deficiency or redundancy” shown in the accompanying table for each

year represents the aggregate amountby which original estimates of reserves as of that year end have

changed in subsequent years. Accordingly, the cumulative deficiency for a year relates only to reserves at

that year-end and those amounts are not additive. Expressed another way, if the original reserves at the

end of 1995 included $4 million for a loss that is finally paid in 2005 for $5 million, the $1 million deficiency

(the excess of the actual payment of $5 million over the original estimate of $4 million) would be included

in the cumulative deficiencies in each of the years 1995 to 2004 shown in the accompanying table.

Various factors may distort the re-estimated reserves and cumulative deficiency or redundancy shown

in the accompanying table. For example, a substantial portion of the cumulativedeficiencies shown in the

accompanying table arise from claims on policies written prior to the mid-1970s involving liability

exposures such as asbestos and environmental claims. In the post-1984 period,the Company has developed

more stringent underwriting standards and policy exclusions and has significantly contracted or terminated