Travelers 2005 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258

|

|

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

165

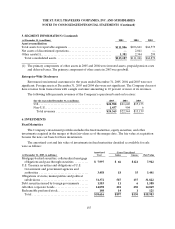

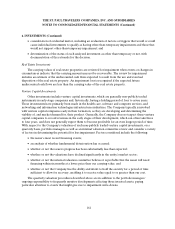

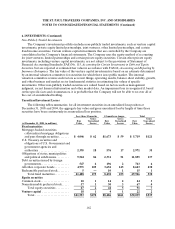

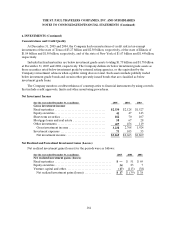

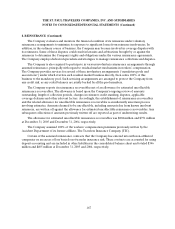

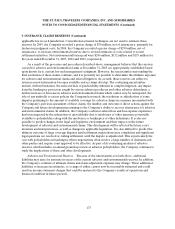

6. INVESTMENTS (Continued)

Changes in net unrealized gains (losses) on investment securities that are included as a separate

component of accumulated other changes in equity from nonownersources were as follows:

(at and for the year ended December 31, in millions) 2005 2004 2003

Change in net unrealized investment gains (losses)

Fixed maturities...................................................... $ ( 885) $ (315 ) $ 442

Equity securities ..................................................... (31 )11 70

Venture capital and other............................................. 64

14 —

(852 )(290 ) 512

Related taxes........................................................ (311 )(98 ) 183

Minority interest..................................................... — — (1)

Change in net unrealized gains (losses) on investment securities.......... (541 )(192 ) 328

Balance, beginningof year. ............................................ 868 1,060 732

Balance, end of year................................................ $327

$868 $1,060

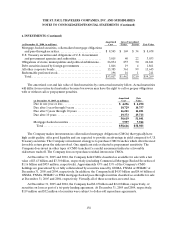

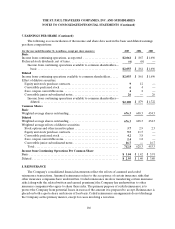

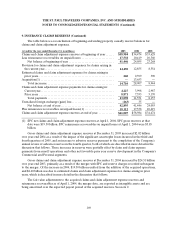

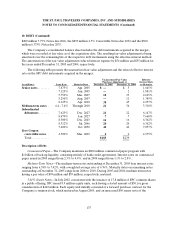

7. EARNINGS PER SHARE

Earnings per share (EPS) was computed in accordance with Statement of Financial Accounting

Standards No. 128, Earnings per Share (FAS 128). Basic EPS was computed by dividing income available to

common shareholders by the weighted average number of common shares outstanding during the period.

The computation of diluted EPS reflected the effect of potentially dilutive securities.

The weighted average number of common shares outstanding applicable to basic and diluted EPS for

all periods prior to April 1, 2004 were restated to reflect the exchange of each share of TPC common stock

for 0.4334 shares of the Company’s common stock.

In 2004, the Company implemented the provisions of FASB EITF 04-8, The Effect of Contingently

Convertible Debt on Diluted Earningsper Share, which provided new guidance on the dilutive effect of

contingently convertible debt instruments. The Company has one debt instrument outstanding towhich the

new guidance applied—its $893 million, 4.50% convertible junior subordinated notes convertible into 16.7

million shares of the Company’s common stock. Income from continuing operationsper diluted share for

the year ended December 31, 2004 excluded the weighted average effects of these notes as the impact

would have been anti-dilutive. For the year ended December 31, 2003, the application of the new guidance

resulted in the restatement of diluted income from continuing operations per share from the previously

reported $3.88 to $3.80.