Travelers 2005 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

162

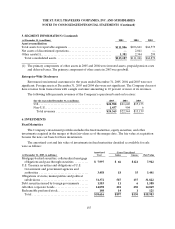

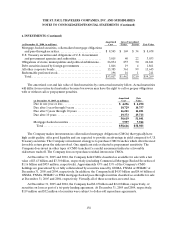

6. INVESTMENTS (Continued)

Non-Publicly TradedInvestments

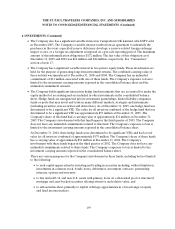

The Company’s investmentportfolio includes non-publicly traded investments, such as venture capital

investments, private equity limited partnerships, joint ventures, other limited partnerships, and certain

fixed income securities. Certain venture capital investments that are controlled by the Company are

consolidated in the Company’s financial statements. The Company uses the equity method of accounting

for joint ventures, limited partnerships and certain private equity securities. Certain other private equity

investments,including venture capital investments, are not subject to the provisions of Statement of

Financial Accounting Standards (FAS) No. 115, Accounting for Certain Investments in Debt and Equity

Securities, but are reported at estimated fair value in accordance with FAS 60, Accounting and Reporting by

Insurance Enterprises. The fair value of the venture capital investments is based on an estimate determined

by an internal valuation committee for securities for which there is no public market. The internal

valuation committee reviews such factors as recent filings, operating results, balance sheet stability, growth,

and other business and market sector fundamental statistics in estimating fair values of specific

investments. Other non-publicly traded securities are valued based on factors such as management

judgment, recent financial information and other market data. An impairment loss is recognized if, based

on the specific facts and circumstances, it is probable that the Company will not be able to recover all of

the cost of an individual holding.

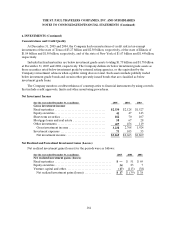

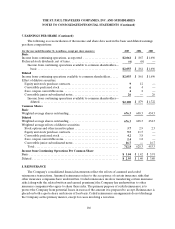

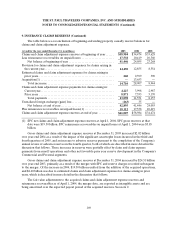

Unrealized Investment Losses

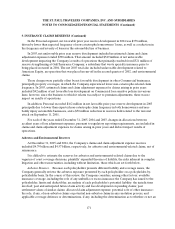

The following tables summarize, for all investment securities in an unrealized loss position at

December 31, 2005 and 2004, the aggregate fair value and gross unrealized loss by length of time those

securities have been continuously in an unrealized loss position.

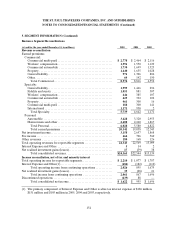

Less than12 months 12 months or longer Total

(at December 31, 2005, in millions)

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fixed maturities

Mortgage-backed securities,

collateralized mortgage obligations

and pass through securities ....... $ 4,046 $ 62 $1,673 $59 $5,719 $ 121

U.S. Treasury securities and

obligations of U.S. Government and

government agencies and

authorities ..................... 2,395 18 576 17 2,971 35

Obligations of states, municipalities

and political subdivisions ......... 9,524 86 2,331 51 11,855 137

Debt securities issued by foreign

governments. ................... 547 4 196 2 743 6

All other corporate bonds .......... 4,971 105 3,652 125 8,623 230

Redeemable preferredstock ........ 5 — 10 1 15 1

Total fixed maturities .......... 21,488 275 8,438 255 29,926 530

Equity securities

Common stock. ................... 101 14 2 24 3

Nonredeemable preferred stock. .... 371 30 3 67 4

Total equity securities ......... 472 44 5 91 7

Venture capital................... 181 4 1 22 2

Total........................ $ 21,553 $ 278 $8,486 $261 $ 30,039 $ 5 39