Travelers 2005 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See notes to consolidated financial statements.

131

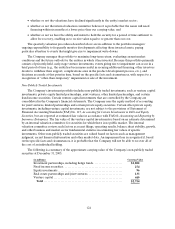

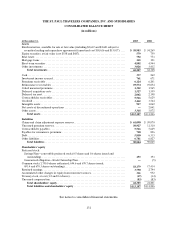

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(in millions)

At December 31, 2005 2004

Assets

Fixed maturities, available for sale at fair value (including $2,667 and $2,603 subject to

securities lending and repurchase agreements) (amortized cost $58,616 and $53,017) .... $ 58,983

$ 54,269

Equity securities, at fair value (cost $538 and $687) ................................... 579

759

Real estate..................................................................... 752

773

Mortgage loans................................................................. 145

191

Short-term securities ............................................................ 4,802

4,944

Other investments.............................................................. 3,026

3,432

Total investments ........................................................... 68,287

64,368

Cash.......................................................................... 337

262

Investment income accrued....................................................... 761

671

Premiums receivable ............................................................ 6,124

6,201

Reinsurance recoverables........................................................ 19,574

19,054

Ceded unearned premiums ....................................................... 1,322

1,565

Deferred acquisition costs ........................................................ 1,527

1,559

Deferred tax asset............................................................... 2,062

2,198

Contractholder receivables....................................................... 5,516

5,629

Goodwill ...................................................................... 3,442

3,564

Intangible assets................................................................ 917

1,062

Net assets of discontinued operations .............................................. — 2,041

Other assets. ................................................................... 3,318

3,072

Total assets ................................................................ $ 1 13,187

$ 1 11,246

Liabilities

Claims and claim adjustment expense reserves. ...................................... $ 61,090

$ 59,070

Unearned premiumreserves...................................................... 10,927

11,310

Contractholder payables ......................................................... 5,516

5,629

Payables for reinsurance premiums ................................................ 720

896

Debt .......................................................................... 5,850

6,313

Other liabilities ................................................................. 6,781

6,827

Total liabilities............................................................. 90,884

90,045

Shareholders’ equity

Preferred stock:

Savings Plan—convertible preferred stock (0.5 shares and 0.6 shares issued and

outstanding) ............................................................... 153

193

Guaranteed obligation—Stock Ownership Plan .................................... — (5)

Common stock (1,750.0 shares authorized; 694.6 and 670.7 shares issued;

693.4 and 670.3 shares outstanding) .............................................. 18,179

17,414

Retained earnings............................................................... 3,750

2,744

Accumulated other changes in equity from nonowner sources .......................... 351

952

Treasury stock,at cost (1.2 and 0.4 shares) .......................................... (47 )(14)

Unearned compensation......................................................... (83 )(83)

Total shareholders’ equity.................................................... 22,303

21,201

Total liabilities and shareholders’ equity ....................................... $ 1 13,187

$ 1 11,246