Travelers 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258

|

|

61

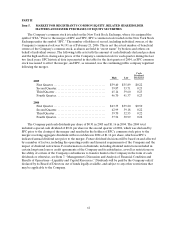

PART II

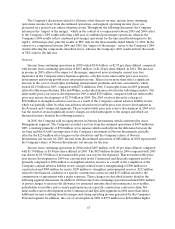

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITYSECURITIES

The Company’s common stock is traded on the New York Stock Exchange, where it is assigned the

symbol “STA.” Prior to the merger of SPC and TPC, SPC’s common stock traded on the New York Stock

Exchange under the symbol “SPC.” The number of holders ofrecord, including individual owners, of the

Company’s common stock was 94,191 as of February 23, 2006. This is not the actual number of beneficial

owners of the Company’s common stock, as shares are held in “street name” by brokers and others on

behalf of individual owners. The following table sets forth the amount of cash dividends declared per share

and the high and low closing sales prices of the Company’s common stock for each quarter during the last

two fiscal years. SPC historical data is presented in the table for the first quarter of 2004, as SPC common

stock was issued to effect the merger, and SPC, as renamed, was thecontinuing public company registrant

following the merger.

High Low

Cash

Dividend

Declared

2005

FirstQuarter ..................................... $39.40 $35.89 $0.22

Second Quarter. .................................. 39.87 33.71 0.23

ThirdQuarter .................................... 45.14 39.60 0.23

Fourth Quarter ................................... 46.70 41.37 0.23

2004

FirstQuarter ..................................... $43.35 $39.20 $0.50

Second Quarter. .................................. 42.99 39.18 0.22

ThirdQuarter .................................... 39.70 32.53 0.22

Fourth Quarter ................................... 37.54 30.99 0.22

The Company paid cash dividends per share of $0.91 in 2005 and $1.16 in2004. The 2004 total

included a special cash dividend of $0.21 per share in the second quarter of 2004, which was declared by

SPC prior to the closing of the merger and resulted in the holders of SPC’s common stock prior to the

merger receiving aggregate dividends with record dates in2004 of $1.16 per share, which was SPC’s

indicated annual dividend rate prior to the merger. Future dividend decisions will be based on and affected

by a number of factors, including the operating results and financial requirements of the Company and the

impact of dividend restrictions. For information on dividends, including dividend restrictions included in

certain long-term loan or credit agreements of the Company and its subsidiaries, as well as restrictions on

the ability of certain of the Company’s subsidiaries to transfer funds to the Company in the form of cash

dividends or otherwise, see Item 7, “Management’s Discussion and Analysis of Financial Condition and

Results of Operations—Liquidity and Capital Resources.” Dividends will be paid by the Company only if

declared by its Board of Directors out of funds legally available, and subject to any other restrictions that

may be applicable to the Company.