Travelers 2005 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

190

13. INCENTIVE PLANS (Continued)

period. Awards granted to non-U.S. participants were in the form of deferred stock awards. These deferred

stock awards are subject to the same conditions as the restricted stock awards except that the shares are

not issued until the vesting criteria are satisfied.

Legacy SPC 1994 Stock Plan

On April 1, 2004, in connection with the merger, the Company assumed approximately 240,000 of

outstanding SPC restricted stock awards related to SPC equity-based compensation plans. These restricted

stock awards retained the same terms and conditionsthat were applicable prior to the merger. Under the

SPC 1994 Stock Plan, the awards of restricted stock were subject to completing a specified objective or

period of employment, generally one to five years. Under the SPC Capital Accumulation Plan,

implemented in 2002, the number of shares included in the restricted stock award is calculated at a 10%

discount from the market price at the date of the award and generally vests in full after a two-year period.

The unvested restricted stock awards require the holder to render service during the vesting period and are

therefore considered unearned compensation. At April 1, 2004, the estimated fair value of the unvested

restricted stock awards subject to amortization was $9million and has been included in unearned

compensation as a separate component of equity. The unearned compensation expense is being recognized

as a charge to income over the remaining vesting period.

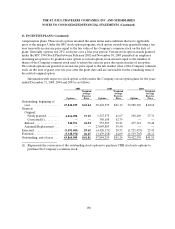

Information with respect to restricted stock and deferred stock awards is as follows:

2005 2004 2003

New shares granted ........................ 2,257,101 1,668,862 947,233

SPCassumed awardsApril 1, 2004 ........... —237,592 —

Weighted average fair value per share at

issuance................................ $ 36.29 $ 37.03 $37.26

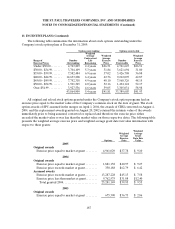

Unearned compensation expense is recognized as a charge to income ratably over the vesting period.

The after-tax compensation cost charged to earnings for these restricted stock and deferred stock awards

was $40million, $26 million and $17 million for the years ended December 31, 2005, 2004 and 2003,

respectively.

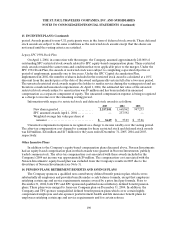

Other Incentive Plans

In addition to the Company’s equity-based compensation plans discussed above, Nuveen Investments

had an equity-based compensation plan in which awardswere granted in Nuveen Investments’ publicly

traded common stock. The after-tax compensation cost associated with these awards included in the

Company’s 2004 net income was approximately $9 million. The compensation cost associated with the

Nuveen Investments’ equity-based plan was excluded from the Company’s results in 2005 due to the

divestiture of Nuveen Investments (see Note 3).

14. PENSION PLANS,RETIREMENT BENEFITS AND SAVINGS PLANS

The Company sponsors a qualified non-contributory defined benefit pension plan, which covers

substantially all employees and provides benefits under a cash balance formula, except that employees

satisfying certain age and service requirements remain covered by a prior final pay formula. Prior to

December 31, 2004, both TPC and SPC sponsored qualified noncontributory defined benefit pension

plans. These plans were merged to form one Company plan on December 31, 2004. In addition, the

Company and TPC sponsor nonqualifieddefined benefit pension plans which cover certain highly-

compensated employees and also sponsor postretirement health and life insurance benefit plans for

employees satisfying certain age and service requirements and for certain retirees.