Travelers 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Workers’ Compensation provides coverage for employers for specified benefits payable under state or

federal law for workplace injuries to employees. There are typically four types of benefits payable under

workers’ compensation policies: medical benefits, disability benefits , death benefits and vocational

rehabilitation benefits. The Company emphasizes managed care cost containment strategies, which involve

employers, employees and care providers in a cooperative effort that focuses on the injured employee’s

early return to work, cost-effective, quality care and customer service in this market.

Commercial Automobile provides coverage for businesses against losses incurred from personal bodily

injury, bodily injury to third parties, property damage to an insured’s vehicle, and property damage to

other vehicles and other property resulting from the ownership, maintenance or use of automobiles and

trucks in a business.

Property provides coverage for loss or damage to buildings, inventory and equipment from natural

disasters, including hurricanes, windstorms, earthquakes, hail, and severe winter weather. Also covered are

manmade events such as theft, vandalism, fires, explosions, terrorism and financial loss due tobusiness

interruption resulting from covered property damage. For additional information on terrorism coverages,

see “Reinsurance—Terrorism Risk Insurance Act of 2002.” Property also includes ocean and inland

marine insurance, which provides coverage for goods in transit, and unique one-of-a-kind exposures.

Commercial Multi-Peril provides a combination of property and liability coverage. Property insurance

covers damages such as those caused by fire, wind, hail, water, theft and vandalism, and protects businesses

from financial loss due to business interruption resulting from a covered loss. Liability coverage insures

businesses against third parties from accidents occurring on their premises or arising out of their

operations, such as injuries sustained from products sold.

International provides coverage predominantly through operations in the United Kingdom, Canada

and the Republic of Ireland, and at Lloyd’s. The coverage provided in those markets includes employers’

liability (similar to workers’ compensation coverage in the United States), public and product liability (the

equivalent of general liability), professional indemnity (similar to directors and officers or errors and

omissions coverages), motor (similar to automobile coverage in the United States) and property. While the

covered hazard may be similar to those in the U.S. market, the different legal environments can make the

product risks and coverage terms potentially very different from those in the United States. International

does not include surety business written in the Company’s Canadian, Me xican or United Kingdom

subsidiaries.

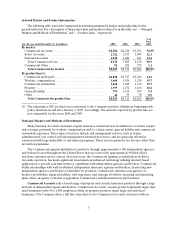

Geographic Distribution

The following table shows the distribution of Specialty’s direct written premiums for the states that

accounted for the majority of Domestic Specialty premium volume for the year ended December 31, 2005:

State

% of

Total

California ........................................................... 12.2 %

Texas. .............................................................. 8.8

New York........................................................... 7.3

Florida ............................................................. 7.0

Illinois.............................................................. 4.2

Pennsylvania ........................................................ 3.6

New Jersey.......................................................... 3.2

Massachusetts ....................................................... 3.0

All Others(1)........................................................ 50.7

Total............................................................. 100.0 %

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in2005

by the Company.