Travelers 2005 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

150

2. MERGER(Continued)

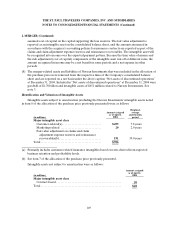

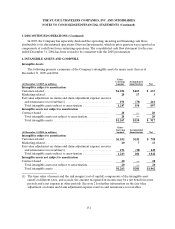

Supplemental Schedule of Noncash Investing and Financing Activities

The allocated purchase price calculated above results in an estimate of the fair value of assets

acquired and liabilities assumed as of the merger date, as follows:

(in millions)

As of April 1,

2004

Assets acquired .................................................. $ 42,989

Liabilities assumed, including debt obligations totaling $3.98billion .... (34,233 )

Allocated purchase price.......................................... $ 8,756

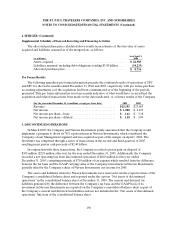

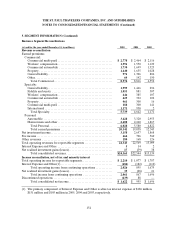

Pro Forma Results

The following unaudited pro forma information presents the combined results of operations of TPC

and SPC for the twelve months ended December 31, 2004 and 2003, respectively, with pro forma purchase

accounting adjustments as if the acquisition had been consummated as of the beginning of the periods

presented. This pro forma informationis not necessarilyindicative of what would have occurred had the

acquisition and related transactions been made on the dates indicated, or of future results of the Company.

(for the year ended December 31, in millions, except per share data) 2004 2003

Revenue .................................................. $ 2 5,195 $ 2 3,683

Net income ............................................... $1,080

$2,123

Net income per share—basic ................................ $1.61

$3.18

Net income per share—diluted .............................. $1.58

$3.09

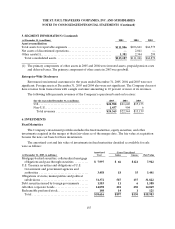

3. DISCONTINUED OPERATIONS

In March 2005, the Company and Nuveen Investments jointly announced that the Company would

implement a program to divest its 78% equity interest in Nuveen Investments, which constituted the

Company’s Asset Management segment and was acquired as part of the merger on April 1, 2004. The

divestiture was completed through a series of transactionsin the second and third quarters of 2005,

resulting in net pretax cash proceeds of $2.40 billion.

In conjunction with these transactions, the Company recorded a pretax gain on disposal of

$345 million ($224 million after-tax) for the year ended December 31, 2005. Additionally, the Company

recorded a net operating loss from discontinued operations of $663 million for the year ended

December 31, 2005, consisting primarily of $710 million of tax expense which resulted from the difference

between the tax basis and the GAAP carrying value of the Company’s investment in Nuveen Investments,

partially offset by the Company’s share of Nuveen Investments’ net income for 2005.

The assets and liabilities related to Nuveen Investments were removed from the respective lines of the

Company’s consolidated balance sheet and reported under the caption “Net assets of discontinued

operations” in the consolidated balance sheet at December 31, 2004. The current and deferred tax

liabilities generated by the difference between the Company’s tax basis and the GAAP basis of its

investment in Nuveen Investments are reported on the Company’s consolidated balance sheet as part of

the Company’s current and deferred tax liabilities and are not included in the “Net assets of discontinued

operations” line item of the consolidated balance sheet.