Travelers 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Property provides coverage for loss or damage to buildings, inventory and equipment from natural

disasters, including hurricanes, windstorms, earthquakes, hail, and severe winter weather. Also covered are

manmade events such as theft, vandalism, fires, explosions, terrorism and financial loss due tobusiness

interruption resulting from covered property damage. For additional information on terrorism coverages,

see “—Terrorism Risk Insurance Act of 2002 and Terrorism Risk Insurance Extension Act of 2005.”

Property also includes specialized equipment insurance, which provides coverage for loss or damage

resulting from the mechanical breakdown of boilers and machinery, and ocean and inland marine, which

provides coverage for goods in transit and unique, one-of-a-kind exposures.

General Liability provides coverage for liability exposures including bodily injury and property

damage arising from products sold and general business operations. Specialized liability policies may also

include coverage for directors’ and officers’ liability arising in their official capacities, employment

practices liability insurance, fiduciary liability for trustees and sponsors of pension, health and welfare, and

other employee benefit plans, errors and omissions insurance for employees, agents, professionals and

others arising from acts or failures to act under specified circumstances, as well as umbrella and excess

insurance. Errors and omissions insurance for professionals (such as lawyers, accountants, doctors and

other health care providers) issometimes also known as professional liability insurance.

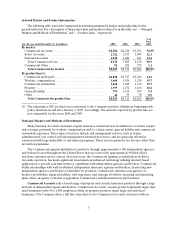

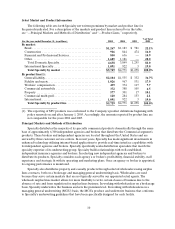

Geographic Distribution

The following table shows the distribution of Commercials’ direct written premiums for the states that

accounted for the majority of premium volume for the year ended December 31, 2005:

State

% of

Total

California ........................................................... 13.5%

New York........................................................... 8.0

Texas. .............................................................. 6.3

Florida ............................................................. 5.3

Illinois.............................................................. 4.8

Massachusetts ....................................................... 4.6

New Jersey.......................................................... 4.5

Pennsylvania ........................................................ 3.7

All Others(1)........................................................ 49.3

Total............................................................. 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in2005

by the Company.

SPECIALTY

The Specialty segment was created upon the merger of TPC and SPC. It combined SPC’s specialty

operations, including SPC’s Bond and Constructionoperations, withTPC’s Bond and Construction

operations, which were included in TPC’s Commercial segment prior to the merger. The Specialty segment

provides a full range of standard and specialized insurance coverages and services through dedicated

underwriting, claims handling and risk management groups. In many of its businesses, Specialty competes

through the use of proprietary rates and policy forms. The segment comprises two primary groups:

Domestic Specialty and International Specialty.