Travelers 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

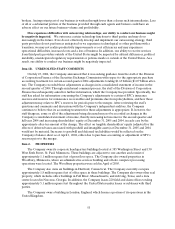

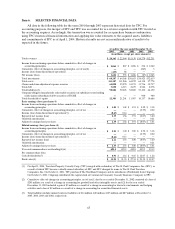

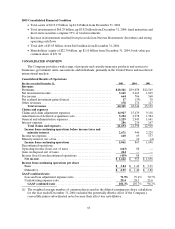

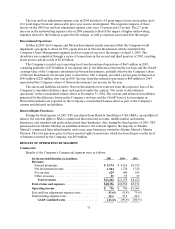

Item 6.SELECTED FINANCIAL DATA

All data in the following table for the years 2001 through 2003 represent historical data for TPC. For

accounting purposes, the merger of SPC and TPC was accounted for as a reverse acquisition with TPC treated as

the accounting acquirer. Accordingly, this transaction was accounted for as a purchase businesscombination,

using TPC’s historical financial information and applying fair value estimates to the acquired assets, liabilities

and commitments of SPC as of April 1, 2004. Historical results are not necessarily indicative of results to be

expected in the future.

At and for the year ended December 31,(1)

2005 2004 2003 2002 2001

(in millions, except per share amounts)

Total revenues...................................................... $ 24,365 $ 22,544 $ 15,139 $ 14,270 $ 12,231

Income from continuing operations before cumulative effect of changes in

accounting principles............................................... $ 2,061$ 867 $1,696 $216 $1,062

Cumulative effect of changes in accounting principles, net of tax(2) ............. —— — (243)3

Income (loss) from discontinued operations............................... (439) 88 — ——

Net income (loss) .................................................... $ 1,622$ 955 $1,696 $ (27) $ 1,065

Total investments.................................................... $ 68,287 $ 64,368 $ 38,653 $ 38,425 $ 32,619

Total assets......................................................... 113,187111,246 64,872 64,138 57,778

Claims and claimadjustment expense reserves............................. 61,090 59,070 34,573 33,736 30,737

Total debt .......................................................... 5,8506,313 2,675 2,5442,078

Total liabilities(3).................................................... 90,884 90,045 52,885 53,100 46,192

Company-obligated mandatorily redeemable securities of subsidiary trusts holding

solely junior subordinated debt securitiesof TIGHI. ...................... —— — 900900

Total shareholders’ equity ............................................. 22,303 21,201 11,987 10,137 10,686

Basic earnings (loss) per share:(4)

Income from continuing operations before cumulative effect of changes in

accounting principles............................................... $ 3.04 $ 1.42 $3.91 $ 0.52 $ 3.18

Cumulative effect of changes in accou nting principles, net of tax ............... —— — (0.59)0.02

Income (loss) from discontinued operations(5) ............................. (0.65)0.14 — ——

Reported net income (loss) ............................................ 2.39 1.56 3.91 (0.07)3.20

Goodwill amortization ................................................ —— — —0.21

Adjusted earnings (loss) per share ....................................... $ 2.39 $ 1.56 $3.91 $ (0.07)$ 3.41

Diluted earnings (loss) per share:(4)

Income from continuing operations before cumulative effect of changes in

accounting principles............................................... $ 2.95 $ 1.40 $3.80 $ 0.52 $ 3.18

Cumulative effect of changes in accounting principles, net of tax ............... —— — (0.59)0.02

Income (loss) from discontinued operations(5) ............................. (0.62)0.13 — ——

Reported net income (loss) ............................................ 2.33 1.53 3.80 (0.07)3.20

Goodwill amortization ................................................ —— — —0.21

Adjusted earnings (loss) per share ....................................... $ 2.33 $ 1.53 $3.80 $ (0.07)$ 3.41

Year-end common shares outstanding(4)(6) ............................... 693.4670.3 435.8 435.1333.3

Per common share data:

Cash dividends(4)(7)................................................. $ 0.91 $ 1.16 $0.65 $ 12.07$ 1.22

Book value(4)....................................................... $ 31.94$ 31.35 $27.51 $ 23.30 $ 32.07

(1)On April 1, 2004, Travelers Property Casualty Corp. (TPC) merged with a subsidiary of The St. Paul Companies, Inc. (SPC), as

a result of which TPC became a wholly-owned subsidiary of SPC and SPC changed its name to The St. Paul Travelers

Companies, Inc.On October 1, 2001, TPC purchased The Northland Company and its subsidiaries (Northland) from Citigroup.

On October 3, 2001, Citigroup contributed the capital stock of Commercial Guaranty Casualty Insurance Company to TPC.

(2) Cumulative effect of changes in accounting principles, net of tax (1) for the year ended December 31, 2002 consisted of a loss of

$243 million as a result of a change in accounting for goodwill and other intangible assets; and (2) for the year ended

December 31,2001 included a gain of $5 million as a resultof a change in accounting for derivative instruments and hedging

activities and a loss of $2 million as a result of a change in accounting for securitized financial assets.

(3) Total liabilities includeminority interest liabilities of $14 million, $20 million, $105 million and $87 million at December 31,

2005,2004, 2003 and 2002, respectively.