Travelers 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

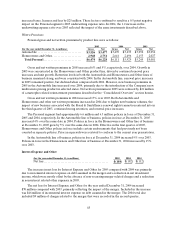

Written Premiums

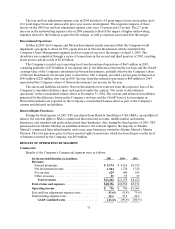

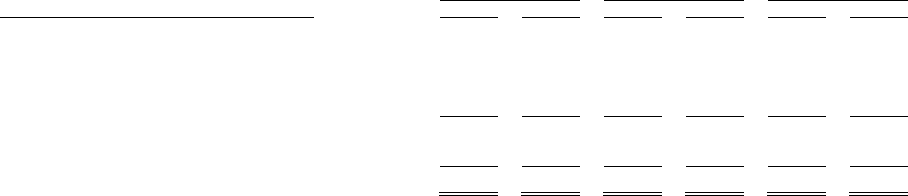

Specialty gross and net written premiums by market were as follows:

2005 2004 2003

(for the year ended December 31, in millions) Gross Net Gross Net Gross Net

Bond..................................... $ 1 ,572 $ 1,267 $1,438 $1,183 $940 $781

Construction............................... 925 916 854 844 487 474

Financial andProfessional Services........... 959 850 664 636 — —

Other..................................... 1,991 1,605 1,455 1,186 — —

Total Domestic Specialty.................. 5,447 4,638 4,411 3,849 1,427 1,255

International Specialty ...................... 1,389 1,091 1,100 922 30 3

Total Specialty........................... $ 6 ,836 $ 5,729 $5,511 $4,771 $1,457 $1,258

Gross and net written premiums in 2005 increased 24% and 20%, respectively, over written premium

volume in 2004. The increase in gross and net written premiums in 2005 primarily reflected the impact of

the merger. Net written premiums in 2005 were reduced by $48 million of reinstatement premiums related

to catastrophe losses that are described in more detail in the “Consolidated Overview” section herein,

whereas net written premiums in 2004 were reduced by $76 million of reinstatement premiums primarily

related to reserving actions in the Bond operation.Gross written premiums in 2005 were level, and net

written premiums were down 2%, compared with 2004 volume on a pro forma combined basis.

Contributing to the decline in net written premiums were the sale of certain credit-related personal lines

classes of business previously written at the Company’s operations at Lloyd’s, and lower business volumes

in Construction related to the now-completed process of aligning the underwriting profile of the two

predecessor companies. These declines were partially offset by premium growth in the Financial and

Professional Services and several other Domestic Specialty businesses. In addition, the elimination of a

reporting lag at the Company’s operations at Lloyd’s resulted in $35 million and $28million of additional

gross and net written premium volume in 2005, respectively. Bondnet written premiums in 2005 were level

with the 2004 pro forma combined premium volume (excluding the impact of reinstatement premiums in

2004). In 2005, approximately $114 million of gross written premiums previously written in the Company’s

Gulf operation in the Commercial segment were written inFinancial and Professional Services, compared

with $90 million of gross written premiums in 2004.

In Domestic Specialty operations, and International Specialty operations excluding Lloyd’s, business

retention levels in 2005 were higher than in 2004. New business levels in Domestic Specialtyoperations

were also higher than in 2004. In International Specialty operations excluding Lloyd’s, new business levels

in 2005 were lower than in2004. Renewal price changes in Domestic Specialty operations, while still

positive, were down from 2004. As discussed previously, in the first quarter of 2005, the Company

implemented changes in the timing and structure of reinsurance purchased in the Specialty segment. Those

changes resulted in a slight increase in ceded premiums in 2005 over what would have been ceded prior to

the changes being implemented.

The $3.51 billion increase in net written premium volume in 2004 over 2003 reflected the impact of

the merger. However, the repositioning of the Bond and Construction books of business primarily

accounted for a decline in net written premium volume in2004 compared with the 2003 pro forma

combined premium volume of SPC and TPC. In Construction, that repositioning resulted in reduced

retention levels when compared with 2003, and new business levels also declined substantially. In Bond, the

repositioning of the book of business was primarily centered in the SPC business acquired in the merger.

Net written premiums in 2004 in the majority of the Company’s remaining Domestic Specialty

businesses were strong, with retention levels at or above historical levels. Renewal price change increases

in these operations moderated throughout the year to the upper single-digit level. New business levels in