Travelers 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258

|

|

2

tax-free to Citigroup, its stockholders and TPC. As part of the ruling process, Citigroup agreed to vote the

shares it continued toholdof TPC following the Citigroup Distribution pro rata with the shares held by the

public and to divest the remaining shares it holds within five years following the Citigroup Distribution.

After the merger, this undertaking also applies to shares of Company common stock.

At December 31, 2005 and 2004, Citigroup held for its own account 1.80% and 6.50% of the

Company’s outstanding common stock, respectively. At December 31, 2003, Citigroup held for its own

account 9.87% of TPC’s outstanding common stock.

The following discussionof the Company’s business is organized as follows: (i) a description of each of

the Company’s three business segments (Commercial, Specialty and Personal) andrelated services; (ii) a

description of Interest Expense and Other; and (iii) certain other information. For a summary of the

Company’s revenues, operating income (loss) and total assets by reportable business segments, see note 5

of notes to the Company’s consolidated financial statements.

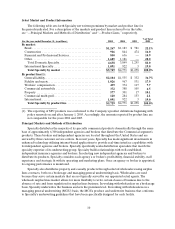

PROPERTY-CASUALTY INSURANCE OPERATIONS

COMMERCIAL

The Commercial segment offers a broad array of property and casualty insurance and insurance-

related services to its clients. Commercial is organized into the following three marketing and underwriting

groups, each of which focuses on a particular client base and which collectively comprise Commercial’s

core operations:

•Commercial Accounts serves primarily mid-sized businesses for casualty products and large and mid-

sized businesses for property products. In addition to the traditional middle market, Commercial

Accounts includes seven units dedicated to unique business needs.

•Select Accounts serves small businesses and offers commercial multi-peril, property, general liability,

commercial auto and workers’ compensation insurance.

•National Accounts comprises three distinct business units. The largest provides casualty products

and services to large companies, with particular emphasis on workers’ compensation, general

liability and automobile liability. National Accounts also includes the commercial residual market

business, which primarily offers workers’ compensation products and services to the involuntary

market. In addition, National Accounts includes Discover Re, which provides unbundled property

and casualty insurance products to insureds who utilize programs such as self-insurance,

collateralized deductibles and captive reinsurers.

Commercial also includes the Special Liability Group (which manages the Company’s asbestos and

environmental liabilities); the assumed reinsurance, health care, and certain international and other runoff

operations; and policies written by the Company’s Gulf operation (Gulf), which was placed into runoff

during the second quarter of 2004. These operations are collectively referred to as Commercial Other.