Travelers 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258

|

|

44

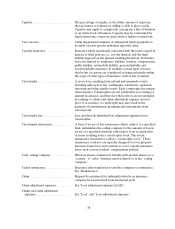

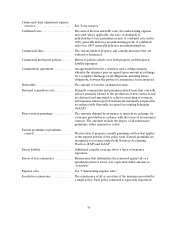

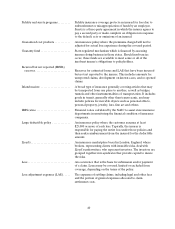

Subrogation....................... A principle of law incorporated in insurance policies, which

enables an insurance company, after paying a claim under a

policy, to recover the amount of the loss from another who is

legally liable for it.

Third-party liability. ................ A liability owed to a claimant (third party) who isnot one of the

two parties to the insurance contract. Insured liability claims are

referred to as third-party claims.

Treaty reinsurance................. The reinsurance of a specified type or category of risks defined

in a reinsurance agreement (a “treaty”) between a primary

insurer or other reinsured and a reinsurer. Typically, in treaty

reinsurance, the primary insurer or reinsured is obligated to

offer and the reinsurer is obligated to accept a specified portion

of all that type or category of risks originally written by the

primary insurer or reinsured.

Umbrella coverage................. A form of insurance protection against losses in excess of

amounts covered by other liability insurance policies or amounts

not covered by the usual liability policies.

Unassigned surplus................. Theundistributed and unappropriated amount of statutory

surplus.

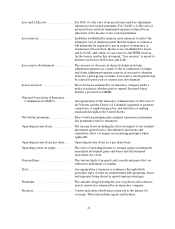

Underwriter ....................... An employee of an insurance company who examines, accepts

or rejects risks and classifies accepted risks in order to charge an

appropriate premium for each accepted risk. The underwriter is

expected to select business that will produce an average risk of

loss no greater than that anticipated for the class of business.

Underwriting ...................... The insurer’sor reinsurer’sprocess of reviewing applications for

insurance coverage, and the decision whether to accept all or

part of the coverage and determination of the applicable

premiums; also refers to the acceptance of that coverage.

Underwriting expense ratio.......... For SAP , it is the ratio of underwriting expenses incurred less

other income to net written premiums. For GAAP, it is the ratio

of underwriting expenses incurred reduced by an allocation of

fee income and billing and policy fees to net earned premiums.

Underwriting gain or loss. ........... Net earned premiums and fee income less claims and claim

adjustment expenses and insurance-related expenses.

Unearned premium ................ The portionof premiumswritten that is allocable to the

unexpired portion of the policy term.

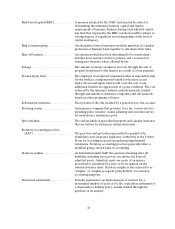

Voluntary market .................. The market in which a person seeking insurance obtains

coverage without the assistance of residual market mechanisms.

Wholesale broker .................. An independent or exclusive agent that represents both

admitted and nonadmitted insurers in market areas, which

include standard, non-standard, specialty and excess and surplus

lines of insurance. The wholesaler does not deal directly with the

insurance consumer. The wholesaler deals with the retail agent

or broker.