Travelers 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

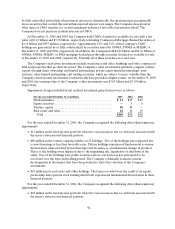

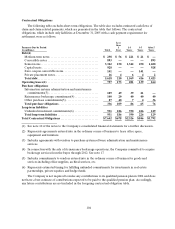

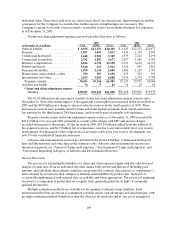

Debt and convertible notes payable outstanding were as follows:

(at December 31, in millions) 2005 2004

Short-term:

Commercial paper. ........................................................... $104

$ 499

Medium-term notes maturing in following year.................................. 56

99

6.75% Senior notes due November15, 2006..................................... 150 —

7.875% Senior notes due April 15, 2005 ......................................... —238

7.125% Senior notes due June 1, 2005 .......................................... —79

Total short-term debt ....................................................... 310 915

Long-term:

Medium-term notes with various maturities through 2010......................... 242 298

6.75% Senior notes due November15, 2006 ..................................... —150

5.75% Senior notes due March 15,2007 ......................................... 500 500

5.01%* Senior notes due August 16,2007 ....................................... 442 —

5.25%* Senior notes due August 16,2007 ....................................... —442

3.75% Senior notes due March 15,2008 ......................................... 400 400

Zero coupon convertible notes due 2009........................................ 122 117

8.125% Senior notes due April 15, 2010 ......................................... 250 250

7.81% Private placement notes due on various dates through 2011.................. 16

20

5.00% Senior notes due March 15,2013 ......................................... 500 500

5.50% Senior notes due December 1,2015 ...................................... 400 —

7.75% Senior notes due April 15, 2026 .......................................... 200 200

7.625% Subordinated debentures due December 15, 2027 ......................... 125 125

8.47% Subordinated debentures due January 10, 2027 ............................ 81

81

4.50% Convertible junior subordinate d notes payable due April 15,2032............ 893 893

6.375% Senior notes due March 15,2033........................................ 500 500

8.50% Subordinated debentures due December 15,2045 .......................... 56

56

8.312% Subordinated debentures due July 1, 2046................................ 73

73

7.60% Subordinated debentures due October 15, 2050............................ 593 593

Total long-term debt........................................................ 5,393 5,198

Total debt principal ........................................................ 5,703 6,113

Unamortized fair valueadjustment............................................. 185 239

Unamortized debtissuance costs............................................... (38 )(39)

Total debt ................................................................. $5,850

$6,313

* These senior notes had an interest rate of 5.25% at December 31, 2004. The interest rate was reset to

5.01% in May 2005 pursuant to the remarketing of these notes as described below.

The Company has the option to defer interest payments on its convertible junior subordinated notes

for a period not exceeding 20 consecutive quarterly interest periods. If the Company elects to defer interest

payments on the notes, it will not be permitted, with limited exceptions, to pay dividends on its common

stock during a deferral period.

In November 2005, the Company issued $400 million of 5.50% senior notes due December 1, 2015.

The notes pay interest semi-annually on June1 and December 1 of each year, beginning June1,2006, are

senior unsecured obligations and rank equally with all of the Company’s other senior unsecured

indebtedness. The Company may redeem some or all of the notes prior to maturity at a redemption price

equal to the greater of: 100% of the principal amountof senior notes to be redeemed; or the sum of the

present values of the remaining scheduled payments of principal and interest on the senior notes to be