Travelers 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

than in 2003. The catastrophe losses in 2004 were primarily driven by four hurricanes that struck the

southeastern United States in the third quarter.

Revenues

Earned Premiums

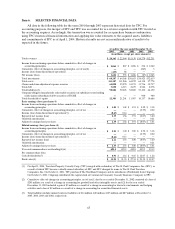

The $1.30 billion increase in earned premiums in 2005 over 2004 primarily reflected the impact of the

merger, which was partially offset by a significant decline in earned premiums in the Commercial segment’s

runoff operations, where business is intentionally beingnon-renewed, and a decline in Commercial’s

ongoing operations due to a lower level of net writtenpremium volume in the last half of 2004 and first

half of 2005. Earned premiums in 2005 were reduced by $121 million of reinstatement premiums related to

catastrophe losses, which are described in more detail in the “Cost of Catastrophe” section of this

discussion. Earned premiums in2004 were reduced by $76 million of reinstatement premiums primarily

related to reserve charges recorded in the Surety operation. Partially offsetting these factors were the

impacts of new business growth and increased retention in many of the Company’s insurance operations in

2005. In 2004, the $6.49 billion growth in earned premiums over 2003 was primarily due to the merger, as

well as the earned premium effect of rate increases on renewal business over the previous 12 months and

strong customer retention levels throughout a majority of the markets served by the Company’s insurance

operations.

Net Investment Income

Net investment income of $3.17 billion in 2005 grew $502 million, or 19%, over 2004, reflecting the

impact of the merger, as well as an increase in invested assets over the last twelve months, higher short-

term interest rates and a decline in investment expenses. The increase in invested assets in 2005 was driven

by continued strong operational cash flows and the investment of the $2.40 billion in proceeds from the

divestiture of the Company’s equity interest in Nuveen Investments. The average pretax investment yield in

2005 of 4.7% declined slightly from 4.8% in 2004, due to the maturity of higher yielding bonds and a higher

proportion of tax-exempt investments. Net investment income in 2004 included $111 million from the

initial public offering of one investment.

Net investment income in 2004 increased $794 million over 2003, largely due to the increase in

invested assets resulting from the merger. In addition, strong operational cash flows in2004 contributed to

the growth in invested assets. The average pretax investment yield in 2004 of 4.8% declined from 5.3% in

2003, due to a higher proportion of tax-exempt investments and lower yields on fixed income securities and

alternative investments. In addition, SPC’s investment portfolio acquired in the merger was recorded at its

fair value as of the merger date in accordance with purchase accounting, which reduced the Company’s

reported average investment yield in 2004.

The Company allocates invested assets and the related net investment income to its identified

business segments. Pretax net investment income is allocated based upon an investable funds concept,

which takes into account liabilities (net of non-invested assets) and appropriate capital considerations for

each segment. The investment yield for investable funds reflects the duration of the loss reserves’ future

cash flows, the interest rate environment at the time the losses were incurred and A+ rated corporate debt

instruments.This duration yield is compared to the average portfolio yield and a new average yield is

determined. It is this average yield that is used in the calculation of net investment income on investable

funds.

Fee Income

Fee income in 2005 declined 6% when compared with 2004, as the National Accounts market, the

primary source of the Company’s fee-based business, experienced increased competition, particularly in