Travelers 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62005 Annual Report 62005 Annual Report

St. Paul Travelers at a Glance

Commercial Net Written Premium: $8.4 billion

St. Paul Travelers offers a wide range of property and casualty insurance products and services to

businesses, organizations and individuals, primarily in the United States and in selected international

markets. St. Paul Travelers is organized into the following business segments: Commercial, Specialty

and Personal.

Commercial and Specialty products are distributed primarily through a network of approximately

6,300 independent agents and brokers, and Personal products are distributed primarily through

approximately 7,800 independent agents.

For more information about St. Paul Travelers and its products and services, visit the company’s

Web site, www.stpaultravelers.com.

Commercial offers a broad array of property and

casualty insurance and insurance-related services to

its clients, which range from small “main street” busi-

nesses to Fortune 100™corporations. Commercial is

organized into marketing and underwriting groups with

a specialized focus on a particular market or product.

These groups include Select Accounts, which markets

packaged property and casualty coverages to small

businesses; Commercial Accounts, which markets

tailored insurance products and services to mid-sized

businesses; and National Accounts, which markets

insurance and risk management services to large com-

panies and also provides claims administration for state-

mandated workers’ compensation pools. In addition,

specialized units are dedicated to underwriting large

property schedules and coverages marketed to national

associations, and to serving the needs of the inland

marine, agriculture, commercial trucking, and boiler

and machinery markets.

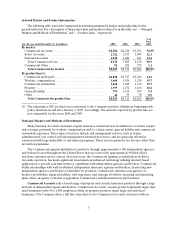

2005 Highlights

• Select Accounts introduced its new exposure-based

definition for underwriting accounts and substantially

expanded its product platform. The new underwriting

definition greatly facilitates agents’ processing of

new business. The newly expanded product platform

includes the addition of 400 new classes of business,

expanded coverage options and the introduction of

new professional endorsements.

• Commercial Accounts partnered with several business

units to develop new business and expand underwriting

and service capabilities; introduced a new program for

commercial wineries in conjunction with Agribusiness;

developed new products for manufacturers and distrib-

utors who import products from overseas; implemented

a small deductible program for retail and real estate

companies; and expanded claim and risk control services

for larger middle market customers.

Boiler & Machinery began offering Equipment

Breakdown coverage on all property policies under-

written through Commercial and Specialty. The

coverage protects against mechanical and electrical

losses at policyholder businesses and eliminates

certain gaps in coverage.

Northland Insurance, a subsidiary of St. Paul

Travelers that is focused on the transportation

industry, announced the national launch of two non-

fleet coverage enhancements to its transportation

insurance offerings: Deluxe Coverage Endorsement,

providing coverage extensions that can minimize

deductibles and extra expenses resulting from a loss,

and Family Emergency Travel Coverage, a travel cost

reimbursement program for family members of an

injured or deceased trucker.

• National Accounts continued to emphasize the deliv-

ery of value-added services to its customers. The unit’s

value proposition is an integrated set of claim, risk

control and management information best practices and

tools that can drive significant reductions in customers’

loss costs. This payout-driven model is important to

the large-risk market, as most customers retain pre-

dictable loss activity, only transferring risk to St. Paul

Travelers in excess of their targeted retention levels.

Given that loss costs frequently represent 75 percent

of customers’ total cost of risk, National Accounts

will continue to invest in services to manage loss costs.