Travelers 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

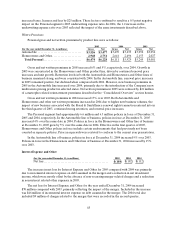

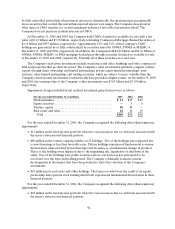

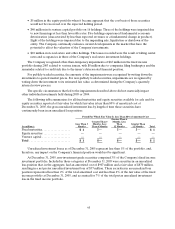

The Company categorizes its asbestos reserves as follows:

Number of

Policyholders Total Net Paid

Net Asbestos

Reserves

(at and for the year ended December 31,$ in millions) 2005 2004 2005 2004 2005 2004

Policyholders with settlement agreements .......... 28 29 $ 1 69 $67

$1,357

$1,431

Home office, field office and other................ 1,748 1,921 172 210 2,483 1,975

Assumed reinsurance andInternational ............ —

—

58 24

524 526

Total ........................................ 1,776 1,950 $ 3 99 $301

$4,364

$3,932

The policyholders with settlement agreements category includes structured agreements, coverage in

place arrangements and, with respect to TPC, Wellington accounts and the settlement of the Statutory and

Hawaii Actions and the Common Law Claims (for a fuller description of these matters, see “Item 3—Legal

Proceedings”) (collectively the “Direct Action Settlement”). Reserves are based on the expected payout

for each policyholder under the applicable agreement. Structured agreements are arrangements under

which policyholders and/or plaintiffs agree to fixed financial amounts to be paid at scheduled times.

Structured agreements include the Company’s obligations related to PPG Industries, Inc. (PPG). In

May 2002 the Company agreed along with approximately three dozen other insurers and PPG on key terms

to settle asbestos related coverage litigation under insurance policies issued to PPG. This settlement is to

be incorporated into the Plan of Reorganization (the Plan) proposed as part of the Pittsburgh Corning

(PC) bankruptcy proceeding. There remain a number of contingencies to consummation of the settlement

including the final execution of documents, court approval of the PC Plan over pending objections,

approval of the settlement and possible appeals. Pursuant to the proposed PC Plan, PC along with

enumerated affiliated companies (including PPG and Corning) are to receive the protections afforded by

Section 524(g) of the Bankruptcy Code from certain asbestos related bodily injury claims. A recent ruling

by the Third Circuit Court of Appeals in the In Re Combustion Engineering, Inc.(CE) matter may impact

the scope of relief that is potentially available to the debtor and other Plan proponents. As a result, the PC

bankruptcy court has sought additional briefing onthe impact of the CE decision on the proposed PC

Plan. The Company cannot predict what effect the CE decision may have with respect to the bankruptcy

court’s approval of the current Plan. A hearing is scheduled to be held on February 28, 2006 before the

bankruptcy court. It is not possible to predict how or when the bankruptcy court will rule on the

outstanding objections or how an appellate court may rule in the event of an appeal. It is possible that the

Company’s single payment contribution pursuant to the proposed settlement of approximately $404

million after reinsurance will be made in calendar year 2006. Coverage in place arrangements represent

agreements with major policyholders on specified amounts of coverage to be provided. Payment

obligations may be subject to annual maximums and are only made when valid claims are presented.

Wellington accounts refer to the 35 defendants that are parties to a 1985 agreement settling certain

disputes concerning insurance coverage for their asbestos claims. Many of the aspects of the Wellington

agreement are similar to those of coverage in place arrangements in which the parties have agreed on

specific amounts of coverage and the terms under which the coverage can be accessed. As more fully

described in Item 3, Legal Proceedings, TPC has entered into the Direct Action Settlement which is still

subject to a number of contingencies. If those contingencies are met, then TPC will pay up to $502 million,

possibly in calendar year 2006. One of the contingencies includes affirmance by all appellate courts of the

orders entered by the United States Bankruptcy Court with respect to the Direct Action Settlement. It is

not possible to predict how or when the appellate courts will rule on the pending appeals.

Home office, field office and other relates to policyholders for which settlement agreements have not

been reached, and also includes unallocated IBNR. Policyholders are identified for home office review

based upon, among other factors: aggregate ultimate expected payments in excess of a specified threshold

(currently $100,000), perceived level of exposure, number of reported claims, products/completed

operations and potential “non-product” exposures, size of policyholder and geographic distribution of