Travelers 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

A ratio result falling outside the usual range of IRIS ratios is not considered a failing result; rather,

unusual values are viewed as part of the regulatory early monitoring system. Furthermore, in some years, it

may not be unusual for financially sound companies to have several ratios withresults outside the usual

ranges. Generally, an insurance company will become subject to regulatory scrutiny if it falls outside the

usual ranges of four or more of the ratios.

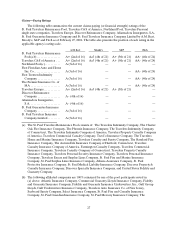

Based on preliminary 2005 IRIS ratios calculated by the Company, most of the Company’s insurance

subsidiaries in the St. Paul Travelers Reinsurance pool had results outside the usual range for the two-year

reserve development ratio, withratios ranging from 20% to 39% (versus the usual value of less than 20%),

due to reserve strengthening actions that occurred in 2004 and the combining of the two pools that

occurred in 2005. In addition, Discover Reinsurance Company had results outside the normal range for the

one-year and two-year reserve development ratios, with ratios of 32% and 116%, respectively, compared to

the usual value of less than 20%, due to reserve strengthening actions in 2005 and 2004. Discover

Reinsurance Company also had a result outside the normal range for the two-year operating ratio (128%

versus the usual value of less than 100%) due to the same reserve strengthening actions.

In 2004, most of the Company’s insurance subsidiaries in the Travelers Property Casualty pool had

IRIS ratio results outside the usual range for the estimated current reserve deficiency to surplus ratio, with

ratios ranging from 26% to 37% above the usual value of less than 25%, due to the lags in the ratio’s ability

to reflect changes in business volume and business mix. Also in 2004, St. Paul Fire and MarineInsurance

Company, United States Fidelity and Guaranty Company, Discover Reinsurance Company and most of the

St. Paul Fire and Marine pool members had unusual values in the one-year and two-year reserve

development ratios above the usual values of less than 20%, due to reserve strengthening actions that

occurred in 2003 and 2004. Those one-year and two-year reserve development ratios for St. Paul Fire and

Marine Insurance Company were 24% and 40%, for United States Fidelity and Guaranty Company the

ratios were 78% and 29%, and for Discover Reinsurance Company the ratios were 64% and 151%. The

one-year and two-year reserve development ratios for the St. Paul Fire and Marinepool members with

unusual values ranged from 22% to 45% and 40% to 93% respectively. United States Fidelity and

Guaranty Company and Discover Reinsurance Company had two-year operating ratios of 159% and

108%, respectively, compared to the usual value of less than 100%, due to the 2004 reserve strengthening

actions. United States Fidelity and Guaranty Company and Discover Reinsurance Company also had

change in surplus ratios of 63% and 78%, respectively, compared to a usual value of less than 50%, due to

2004 capital contributions from their parent companies. Discover Reinsurance Company also had a surplus

aid to surplus ratio of 17% compared to the usual value of less than 15%.

Management does not anticipate regulatory action as a result of the 2005 IRIS ratio results. In all of

these instances in prior years, regulators have been satisfied upon follow-up that no regulatory action was

required. It is possible that similar results could occur in the future. No regulatory action has been taken by

any state insurance department or the NAIC with respect to IRIS ratios of any of the Company’s insurance

subsidiaries for the year ended December 31, 2004.

Risk-Based Capital (RBC) Requirements

In order to enhance the regulation of insurer solvency, the NAIC has adopted a formula and model

law to implement RBC requirements for most property and casualty insurance companies, which is

designed to determine minimum capital requirements and to raise the level of protection that statutory

surplus provides for policyholder obligations. The RBC formula for property and casualty insurance

companies measures three major areas of risk facing property and casualty insurers:

•underwriting, which encompasses the risk of adverse loss developments and inadequate pricing;

•declines in asset values arising from market and/or credit risk; and