Travelers 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

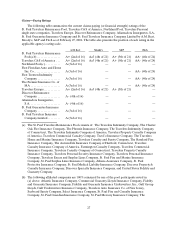

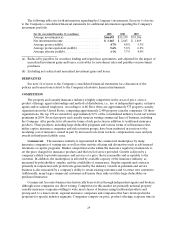

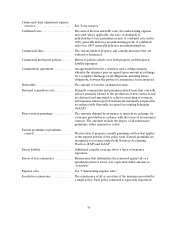

The following table sets forth information regarding the Company’s investments. See note 6 of notes

to the Company’s consolidated financial statements for additional information regarding the Company’s

investment portfolio.

(for the year ended December 31, in millions) 2005 2004 2003

Average investments(a).......................... $ 6 6,695 $ 5 5,139 $ 3 5,306

Net investment income.......................... $3,165 $2,663 $1,869

Average pretax yield(b).......................... 4.7%4.8 % 5.3 %

Average pretax equivalent yield(b)................ 5.6%5.6 % 6.2 %

Average aftertax yield(b). ........................ 3.7%3.7 % 4.0 %

(a) Reduced by payables for securities lending and repurchase agreements, and adjusted for the impact of

unrealized investment gains and losses, receivables for investment sales and payables on investment

purchases.

(b) Excluding net realized and unrealized investment gains and losses.

DERIVATIVES

See note 16 of notes to the Company’s consolidated financial statements for a discussion of the

policies and transactions related to the Company’s derivative financial instruments.

COMPETITION

The property and casualty insurance industry is highly competitive in the areas of price, service,

product offerings, agent relationships and method of distribution, i.e., use of independent agents, exclusive

agents and/or salaried employees. According to A.M. Best, there are approximately 975 property casualty

organizations in the United States, comprising approximately 2,400 property casualty companies. Of those

organizations, the top 150 accounted for approximately 92% of the consolidated industry’s total net written

premiums in2004. Several property and casualty insurers writing commercial lines of business, including

the Company, offer products for alternative forms of risk protection in addition to traditional insurance

products. These products, including large deductible programs and various forms of self-insurance that

utilize captive insurance companies and risk retention groups, have been instituted in reaction to the

escalating cost of insurance caused in part by increased costs from workers’ compensation cases and jury

awards in third-party liability cases.

Commercial. The insurance industry is represented in the commercial marketplace by many

insurance companies of varying size as well as other entities offering risk alternatives such as self-insured

retentions or captive programs. Market competition works within the insurance regulatory framework to

set the price charged for insurance products and the level of service provided. Growth is driven by a

company’s ability to provide insurance and services at a price that is reasonable and acceptable to the

customer. In addition, the marketplace is affected by available capacity of the insurance industry, as

measured by policyholders’ surplus, and the availability of reinsurance. Surplus expands and contracts

primarily in conjunction with profit levels generated by the industry. Growth in premium and service

business is also measured by a company’s ability to retain existing customers and to attract new customers.

Additionally, many large commercial customers self-insure their risks or utilize large deductibles on

purchased insurance.

Commercial Accounts business has historically been written through independent agents and brokers,

although some companies use direct writing. Competitors in this market are primarily national property

casualty insurance companies willing to write most classes of business using traditional products and

pricing and, to a lesser extent, regional insurance companies and companies that have developed niche

programs for specific industry segments. Companies compete on price, product offerings, response time in