Travelers 2005 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

176

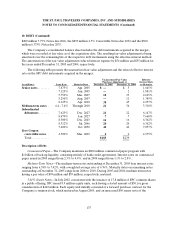

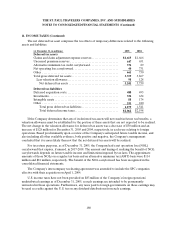

10. DEBT (Continued)

Company (maturing in 2007). Total annual distributions on the equity units were at the rate of 9.00%,

consistingof interest on the note at a rate of 5.25% and fee payments under the forward contract of 3.75%.

Holders of the equity units had the opportunity to participate in a required remarketing of the senior note

component. The initial remarketing date was May 11, 2005. On that date, the notes were successfully

remarketed, and the interest rate on the notes was reset to 5.01%, from 5.25%, effective May 16, 2005. The

remarketed notes mature on August 16, 2007. The forward purchase contract required the investor to

purchase, for $50, a variable numberof shares of the Company’s common stock on the settlement date of

August 16, 2005. The number of shares purchased was determined based on a formula that considered the

average closing price of the Company’s common stock on each of 20 consecutive trading days ending on

the third trading day immediately preceding the settlement date, in relation to the $24.20 per share price of

common stock at the time of the offering. On the August 16, 2005 settlement date, the Company issued

15.2 million common shares and received total proceeds of $442 million.

5.50% Senior Notes— In November 2005, the Company issued $400 million of 5.50% senior notes due

December 1, 2015. The notes pay interest semi-annually on June 1 and December 1 of each year,

beginning June 1, 2006, are senior unsecured obligations and rank equally with all of the Company’s other

senior unsecured indebtedness. The Company may redeem some or all of the notes prior to maturity at a

redemption price equal to the greater of: 100% of the principal amount of senior notes to be redeemed; or

the sum of the present values of the remaining scheduled payments of principal and interest on the senior

notes to be redeemed (exclusive of interest accrued to the date of redemption) discounted to the date of

redemption on a semiannual basis at the then currentTreasury Rate plus 20 basis points. The majority of

the proceeds from the issuance of the 5.50% senior notes was used to pay down the Company’s commercial

paper outstanding, with the remainder used for general corporate purposes.

Zero CouponConvertible Notes—The zero coupon convertible notes mature in 2009, but are

redeemable at the option of the Company for an amount equal to the original issue price plus accreted

original issue discount. Eachnote is convertible at the option of the holder at any time on or prior to

maturity, unless previously redeemed by the Company, into common stock of the Company at a conversion

rate of 16.6433 shares for each $1,000 principal amount of notes.

3.75%, 5.00%, 6.375% Senior Notes— On March 11, 2003, the Company issued $1.40 billion of senior

notes comprising $400 million of 3.75% senior notes due March 15, 2008, $500 million of 5.00% senior

notes due March 15, 2013 and $500 million of 6.375% senior notes due March 15, 2033. The notes pay

interest semi-annually on March15 and September 15 of each year, beginning September 15, 2003, are

senior unsecured obligations and rank equally with all of the Company’s other senior unsecured

indebtedness. The Company may redeem some or all of the notes prior to maturity by paying a “make-

whole” premium based on U.S. Treasury rates. The net proceeds from the sale of these notes were

contributed to TIGHI, so that TIGHI could prepay and refinance $500 million of 3.60% indebtedness to

Citigroup and to redeem $900 million aggregate principal amount of TIGHI’s 8.00% and 8.08% junior

subordinated debt securities held by subsidiary trusts. These trusts, in turn, used these funds to redeem

$900 million of preferred capital securities on April 9, 2003.