Travelers 2005 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

•whether ornot the valuations have declined significantly in the entity’s market sector;

•whether or not the internal valuation committee believes it is probable that the issuer will need

financing within six months at a lower price than our carrying value; and

•whether ornot we have the ability and intent to hold the security for a period of time sufficient to

allow for recovery, enabling us to receive value equal to or greater than our cost.

The quarterly valuation procedures described above are in addition to the portfolio managers’

ongoing responsibility to frequently monitor developments affecting those invested assets, paying

particular attention to events that might give rise to impairment write-downs.

The Company manages the portfolio to maximize long-term return, evaluating current market

conditions and the future outlook for the entities in which it has invested. Because this portfolio primarily

consists of privately-held, early-stage venture investments, events giving rise to impairment can occur in a

brief period of time (e.g., the entity has been unsuccessful in securing additional financing, other investors

decide to withdraw their support, complications arise in the product development process, etc.), and

decisions are made at that point in time, based on the specific facts and circumstances, with respect to a

recognition of “other-than-temporary” impairment or sale of the investment.

Non-Publicly TradedInvestments

The Company’s investmentportfolio includes non-publicly traded investments, such as venture capital

investments, private equity limited partnerships, joint ventures, other limited partnerships, and certain

fixed income securities. Certain venture capital investments that are controlled by the Company are

consolidated in the Company’s financial statements. The Company uses the equity method of accounting

for joint ventures, limited partnerships and certain private equity securities. Certain other private equity

investments,including venture capital investments, are not subject to the provisions of Statement of

Financial Accounting Standards (FAS) No. 115, Accounting for Certain Investments in Debt and Equity

Securities, but are reported at estimated fair value in accordance with FAS 60, Accounting and Reporting by

Insurance Enterprises. The fair value of the venture capital investments is based on an estimate determined

by an internal valuation committee for securities for which there is no public market. The internal

valuation committee reviews such factors as recent filings, operating results, balance sheet stability, growth,

and other business and market sector fundamental statistics in estimating fair values of specific

investments. Other non-publicly traded securities are valued based on factors such as management

judgment, recent financial information and other market data. An impairment loss is recognized if, based

on the specific facts and circumstances, it is probable that the Company will not be able to recover all of

the cost of an individual holding.

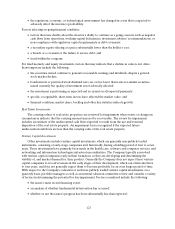

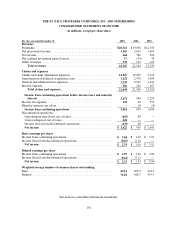

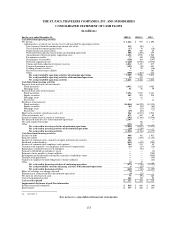

The following is a summary of the approximate carrying value of the Company’s non-publicly traded

securities at December 31, 2005:

(in millions) Carrying Value

Investment partnerships, including hedge funds. .................... $ 1,802

Fixed income securities.......................................... 274

Equity investments.............................................. 96

Real estate partnerships and jointventures. ........................ 133

Venture capital................................................. 449

Total ........................................................ $ 2,754