Travelers 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

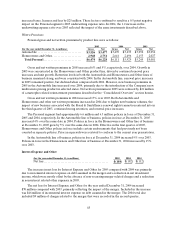

Overview

Operating income of $679 million in 2005 improved by $1.33 billion over the operating loss of

$648 million in 2004. The significant improvement in 2005 operating income reflected the absence of net

unfavorable prior year reserve development, as well as strong net investment income, improved current

accident year results in several domestic businesses (particularly Bond) and lower commission expenses in

certain business units. Operating results in 2005 included a cost of catastrophes of $356 million (net of

reinsurance and including reinstatement premiums), compared with $220 million of such costs in 2004. The

operating loss of $648 million in2004was driven by net unfavorable prior year reserve development of

$1.43 billion, including significant charges related to the construction and surety reserves acquired in the

merger, as well as other reserving actions that are described in the narrative that follows. Operating results

in 2004 also included $220 million for the cost of catastrophes resulting from the four hurricanes described

previously, whereas 2003 results included no catastrophe losses.

Earned Premiums

Earned premiums in 2005 increased $1.10 billion, or 24%, over 2004, primarily reflecting the impact of

the merger. Earned premiums in 2005 were reduced by the $48 million in reinstatement premiums related

to the hurricane losses described in the “Consolidated Overview” section herein. Earned premiums in 2005

also reflected the inclusion of one additional month ofpremium volume totaling $37 million to eliminate a

reporting lag at the Company’s operations at Lloyd’s, the impact of which was partially offset by the sale of

certain classes of personal insurance business at those Lloyd’s operations. Earned premiums in 2004 were

reduced by $76 million of reinstatement premiums primarily related to a reserve charge in the Company’s

Bond operation. Earned premiums of $4.64 billion in 2004 grew $3.47 billion over 2003, primarily

reflecting the impact of the merger

Net Investment Income

Refer to the “Net Investment Income” section of the “Consolidated Results of Operations” discussion

herein for a description of the factors contributing to the increase in the Company’s net investment income

in 2005and 2004.

Claims and Expenses

Claims and claims adjustment expenses in 2005 included $308 million of current year catastrophe

losses, compared with catastrophe losses of $209 million recorded in 2004. Catastrophe losses in both

periods were driven by the hurricanes described in the “Consolidated Overview” section herein. Net

favorable prior year reserve development in 2005 totaled $9 million, as favorable development in

International operations was largely offset by unfavorable development related to 2004 hurricane losses in

the Personal Catastrophe Risk operation. Net unfavorable prior year reserve development totaled

$1.43 billion in 2004, which included charges to increase the estimate of the acquired net construction

reserves by $500 million and the acquired net surety reserves in the Company’s Bond operation by $300

million, as well as a $252 million charge related to the financial condition of a construction contractor. The

following discussion provides more information regarding the net unfavorable prior year loss development

related to these items in 2004, as well as other reserving actions.

Upon having access to each company’s detailed policyholder information,including underwriting,

claim, and actuarial files on April 1, 2004, in connection with the closing of the merger, the Company was

able to begin the detailed process of developing a uniform and consistent approach to estimating the

combined company’s loss reserves. As part of that process, a team of actuaries representing the historical

actuarial perspectives, judgments and methods applied by each legacy company, discussed their views,

methodologies, and analysis of available data.