Travelers 2005 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

148

2. MERGER (Continued)

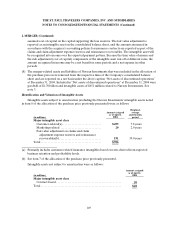

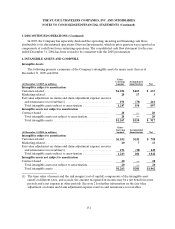

Allocation of the PurchasePrice

The purchase price was allocated based on an estimate of the fair value of the assets acquired and

liabilities assumed as of April 1, 2004, as follows:

(in millions)

Net tangible assets(1)................................................................. $5,351

Total investments(2).................................................................. 423

Deferred policy acquisitioncosts(3).................................................... (100)

Deferred federal income taxes(4). ...................................................... 130

Goodwill(5) (8) ...................................................................... 1,030

Other intangible assets, including the fair value adjustment of claim and claim adjustment

expense reserves and reinsurance recoverables of$191(6) (7) (8) ......................... 726

Net assets ofdiscontinued operations(8)................................................ 2,143

Other assets(2). ...................................................................... (103)

Claims and claim adjustment expense reserves(3)........................................ (26)

Debt(2)............................................................................. (333)

Other liabilities(2).................................................................... (485)

Allocated purchase price .............................................................. $8,756

(1) Reflects SPC’s shareholders’ equity of $6,439 million, less SPC’s historical goodwill of $950 million

and intangible assets of $138 million.

(2) Represents adjustments for fair value.

(3) Represents certain adjustments to conform SPC’s accounting policies to those of TPC’s that affected

the purchase price allocation.

(4) Represents a deferred tax liability associated with adjustments to fair value of all assets and liabilities

included herein excluding goodwill, as this transaction is not treated as a purchase for tax purposes.

(5) Represents the excess of the purchase price (cost) over the amounts assigned to the assets acquired

and liabilities assumed. None of the goodwill is deductible for tax purposes. The decrease in goodwill

compared with that originally reported at the merger date was due to the adjustment related to

Nuveen Investments described in (8) below, as well as certain purchase accounting and tax

adjustments since the completion of the merger.

(6) Represents identified finite and indefinite life intangible assets, primarily customer-related insurance.

See note 4.

(7) An adjustment has been applied to SPC’s claims and claim adjustment expense reserves and

reinsurance recoverables at the acquisition date to estimate their fair value. The fair value adjustment

of $191 million was based on management’s estimate of nominal claim and claim expense reserves and

reinsurance recoverables (after adjusting for conformity with the acquirer’s accounting policy on

discounting of workers’ compensation reserves), expected payment patterns, the April 1, 2004 U.S.

Treasury spot rate yield curve, a leverage ratio assumption (reserves to statutory surplus), and a cost

of capital expressed as a spread over risk-free rates. The method used calculates a risk adjustment to a

risk-free discounted reserve that will, if reserves run off as expected, produce results that yield the