Travelers 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

be fully controlled, particularly when interest rates move dramatically, the investment process generally

favors securities that control this risk within expected interest rate ranges. The Company does invest in

other types of CMO tranches if a careful assessment indicates a favorable risk/return tradeoff. The

Company does not purchase residual interests in CMOs.

At December 31, 2005 and 2004, the Company held CMOs classified as available for sale with a fair

value of $3.43 billion and $3.30 billion, respectively (excluding Commercial Mortgage-Backed Securities of

$1.16 billion and $953 million, respectively). Approximately 43% and 53% of the Company’s CMO

holdings are guaranteed by or fully collateralized by securities issued by GNMA, FNMA or FHLMC at

December 31, 2005 and 2004, respectively. In addition, the Company held $4.83 billion and $4.66 billion of

GNMA, FNMA, FHLMC or FHA mortgage-backed pass-through securities classified as available for sale

at December 31, 2005 and 2004, respectively. Virtually all of these securities are rated Aaa.

The Company’s real estate investments include warehouses and office buildings and other commercial

land and properties that are directly owned. The Company’s other investments primarily comprise venture

capital, through direct ownership and limited partnerships, private equity limited partnerships, joint

ventures, other limited partnerships and trading securities, which are subject to more volatility than the

Company’s fixed income investments, buthistorically have provided a higher return. At December 31, 2005

and 2004, the carrying value of the Company’s other investments was $3.03 billion and $3.43 billion,

respectively.

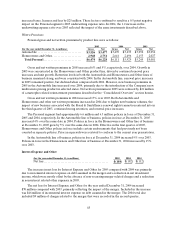

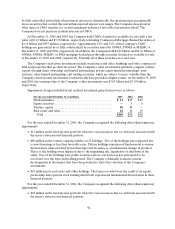

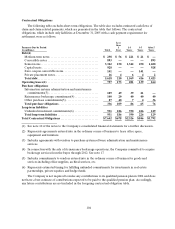

Impairment charges included in net realized investment gains (losses) were as follows:

(for the year ended December 31, in millions) 2005 2004 2003

Fixed maturities ......................................... $ 11$25 $65

Equitysecurities......................................... —5 6

Venture capital.......................................... 8040 —

Real estate and other. .................................... 1810 19

Total................................................. $ 1 09 $80 $90

For the year ended December 31, 2005, the Company recognized the following other-than-temporary

impairments:

•$11million in the fixed income portfolio related to various issuers due to credit risk associated with

the issuer’s deteriorated financial position.

•$80million in the venture capital portfolio on 22 holdings. Two of the holdings were impaired due

to new financings at less than favorable rates. Fifteen holdings experienced fundamental economic

deterioration (characterized by less than expected revenues or a fundamental change in product).

Three of the holdings were impaired due to the impending sale, liquidation or shutdown of the

entity. Two of the holdings were public securities whose cost basis was not anticipated to be

recovered over the expected holding period. The Company continually evaluates current

developments in the market that have the potential to affect the valuation of the Company’s

investments.

•$18 million inits real estate and other holdings. The losses recorded were the result of an equity

partnership and a private stock holding which both experienced fundamental deterioration in their

financial position.

For the year ended December 31, 2004, the Company recognized the following other-than-temporary

impairments:

•$25million in the fixed income portfolio related to various issuers due to credit risk associated with

the issuer’s deteriorated financial position.